As longtime wealth advisors, we’ve seen this first-hand: The benefits of good financial decisions tend to compound over time, creating a lifetime advantage. Based on our work with multiple generations within families, we thought it would be useful to offer some key advice for each decade of life.

Each situation is different, of course, and much of our advice applies at any age. So our suggestions are a starting point. They are meant to launch conversations, especially with the younger people in your family, about where they are now and where they would like to be years from now. We can then advise you and them on the best way to get there.

Twenties – Get the Early Bird Advantage

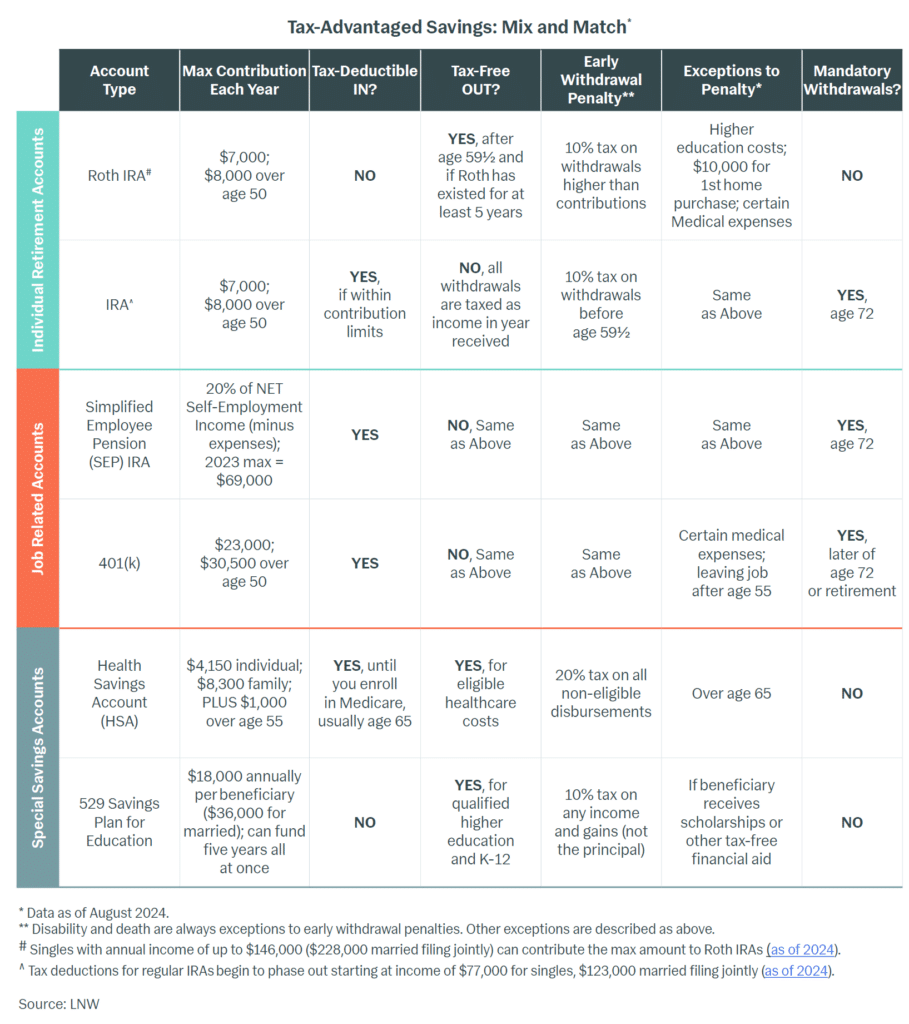

Open a Roth IRA, which lets you leverage youth and a lower tax bracket. The beauty of a Roth is that it inhabits a tax-free zone, even on withdrawals, starting at age 59 ½. And it is flexible. At any age, you can withdraw the principal tax-free to pay for college/grad school, and up to $10,000 for a first-home down payment. And at most income levels, you can contribute to a Roth and your company’s pension plan.

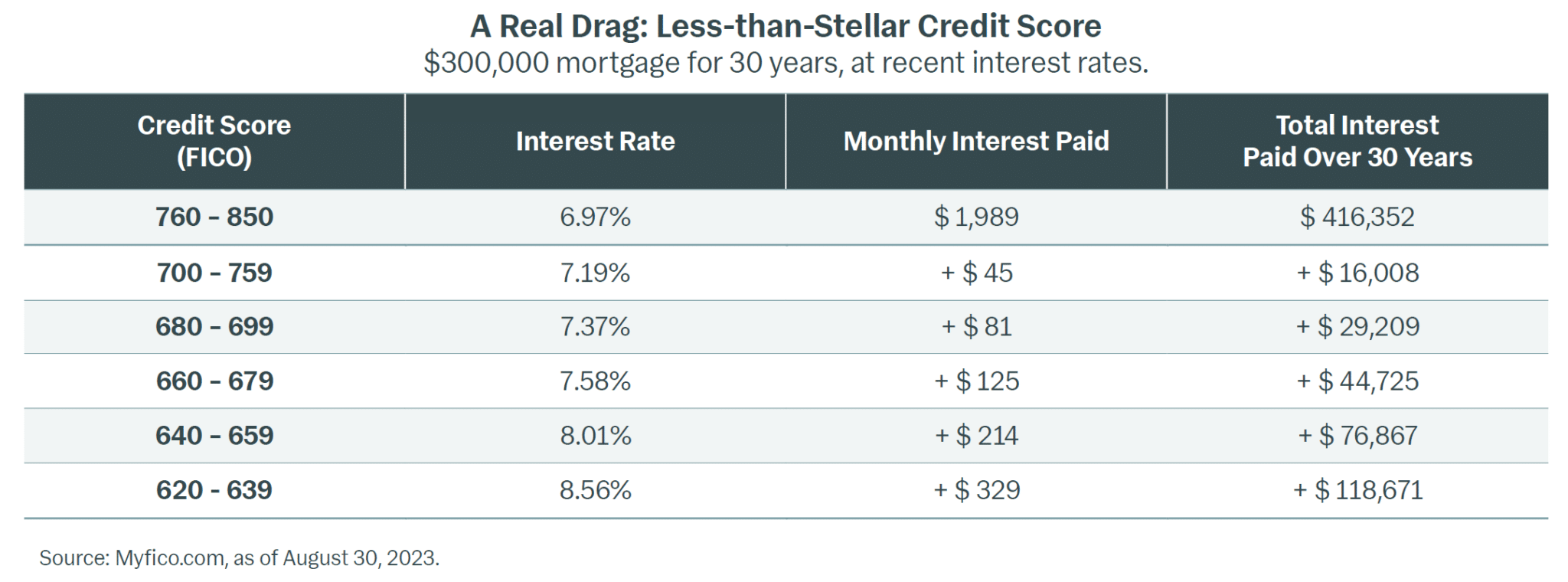

Strive for a stellar credit score. A high credit score saves you money each month on interest payments (see chart below), money you can save and invest. Paying off credit card balances every month is also a great way to control spending.

Mind the Gender Pay Gap. Women tend to earn less than men for comparable work, with estimates ranging from 5% to 20% less, depending on the dataset. Over a lifetime, even 5% can add up to a tidy sum. As young people enter the workforce, we encourage them — especially women — to research average compensation for their field at the local level (including stock options if applicable) and to gain confidence in negotiating a salary.

Thirties – Start Aligning Finances with Values

Make financial decisions in context of who YOU are. Just because you qualify for a hefty mortgage doesn’t mean it’s a good idea. What do you want to do: Start a new business? Travel? Be debt-free by the time the kids are in college? Make your mortgage and other finances suit your personality and life choices, not the other way around.

Manage risk. Be wary of having most of your net worth tied up in any one investment, even if it seems “solid,” such as real estate or the company you work for or own. If you have a family, have a will and an estate plan. A good estate plan will transfer assets to your heirs privately, tax-efficiently, and in line with your wishes. If your asset base is not yet accessible (inheritance, equity comp, shares in a startup, etc.) or enough to cover your family’s long-term needs, buy 20-year disability and term insurance in your 30s because it’s then inexpensive.

Be mindful of titling. California, Washington and seven other states are community property states, meaning that all assets acquired during marriage (other than by gift or inheritance) are jointly owned. Keep your pre-marriage and all inherited assets in your name unless you intend to make a gift to your spouse.

Forties – Save Deliberately

Set up and use a “Savings & Investing Budget.” This decade is key for ramping up wealth to be used for education, healthcare and retirement. That is, at least, the theory.

In practice, most people do not save methodically in their 30s and 40s for three reasons:

- Pressing new demands, from home renovation to business ventures to private tuition.

- Confusion about how much money to put into which account;

- Unwillingness to lock away money for decades.

This is why a Savings & Investing Budget is helpful.

The budget specifies how much you’ll put into each tax-advantaged accounts each year, and how much in taxable accounts as well as the types of assets in each. You want to use (in varying amounts) all the tax-advantaged options you qualify for, balancing out their pros and cons (full taxation of withdrawals, mandatory withdrawals, etc.).

Don’t overlook Health Savings Accounts (HSAs). If you have a high-deductible health insurance plan, take advantage of the option to open an HSA. A couple over 65 is likely to need $220,000 for health care in retirement, in addition to expenses covered by Medicare. The HSA can be a great source of tax-free money to pay some of those bills.

Fifties – Strategize and Prioritize

Trace out your retirement income stream. Ideally, you want retirement income to come from a variety of sources – investments, rents, pensions, Social Security, IRAs, part-time work, etc. – whose withdrawal and tax requirements differ. You can then optimize when and how to take payments from each source, while allowing your principal to keep growing over time.

Evaluate succession and/or exit strategies, if you own a business. Letting go of a business requires careful advance planning, usually years in advance, to make sure you’re making the best possible decisions in terms of taxes, your estate, lifestyle and family harmony.

For kids going to college, look into applying for financial aid. Families with relatively high incomes sometimes do qualify for aid. Assets in retirement accounts do not count, and the value of your primary residence either doesn’t count or is capped at 1 to 4 times your income.

Sixties – Set the Stage for Second Acts

Create a Plan B. Develop an interest or new work that lets you keep active and connected. Numerous studies show that socially active people in their 60s, 70, 80s and 90s are healthier and happier.

Firm up housing plans. Do you sell your primary residence? Buy a new one? Rent? Live elsewhere part of the year? There are an increasing number of alternatives to staying in the family home, both in the U.S. and abroad.

Plan for health issues. If applicable, consider buying long-term care insurance in your 60s, when it is still affordable. Include a Living Will or Healthcare Directive in your estate plan.

Seventies & Beyond – Fully Align Finances and Values

Simplify. Gift or sell under-used properties and other assets, consolidate financial accounts, and make sure assets are titled as you intend. Your spouse and heirs will be grateful.

Focus on legacy. Adjust your estate plan so it fully reflects your values, be it providing for your heirs, a cause you feel strongly about or both. Decide how much to gift during your lifetime vs. through your estate plan, and how to accomplish this in the most effective way, not only in terms of taxes but in terms of impact that is significant and long-lasting.

Reassess risk. Assess for whom you’re investing now – for yourself and spouse, or mostly to provide for the next generation? As counterintuitive as it may seem, investing an inheritance for the next gen can mean taking on more portfolio risk as you age.

Financially Fit Families

Know the “money personality” of each family member and then work to accentuate the positive and offset the negative. Big spenders, for example, are encouraged to start automatic savings deposits or track spending with an app. Excessive savers are invited to take some risks and pursue their passions.

Teach pre-schoolers to make choices, and layer on money messages as they grow. This can begin in store aisles helping toddlers choose between two things they want NOW. Each year, layer on activities and talks – what we call Money Messages – that prepare kids to become financially savvy and independent.

Plan for three-generation retreats or vacations. Bringing grandparents, parents and kids together in a place far from home can allow for relaxed but important talk about values, goals and finances.