Private Equity, Real Assets and Diversifiers

Expand Your Opportunity Set

Investing beyond the traditional markets.

As your wealth advisors, we are constantly seeking to expand your opportunity set through investments beyond the public markets. Our goal: atypical sources of return to reduce your overall portfolio risk while attaining the results you need to achieve your goals.

Our investment strategies can include:

Diversifiers — hedge funds and private debt

Real Assets — real estate, infrastructure, natural resources

Private Equity — venture capital and growth, buyout, distressed and/or secondary offering strategies

Hedge funds and other alternative investments trade in the public markets to take advantage of pricing inefficiencies and trends. The focus and the strategies vary widely, resulting in different levels of correlation with the returns in traditional markets. In contrast, debt and equity investments in the private markets, including venture capital are not publicly traded.

Our goal is to assess and suggest only the non-traditional investments we have high conviction will add value to your portfolio in context of everything else you own. For example, you may already have substantial private market investments through ownership of a business, investment real estate or other assets, and we’ll consider that as we make recommendations for your portfolio.

What Is Right for You

We do not recommend private market investments, real assets or diversifiers (hedge funds and private debt) to check off investment boxes. For qualifying clients, we’ll suggest such investments only if we are convinced they will provide a true benefit to your portfolio and align with your wealth plan, your finances and your goals. To identify the right opportunities for you and your portfolio, we start by exploring the following topics in context of your situation:

- Diversification. Perhaps you own a business or have a sizable real estate portfolio. If so, you might already have most of your assets in the private markets and need to reassess and perhaps rebalance before committing more.

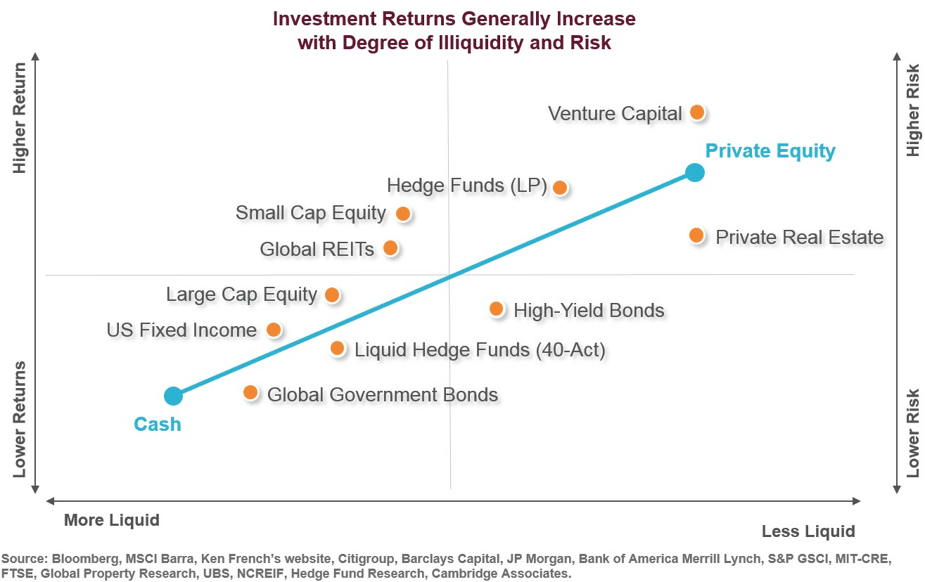

- Liquidity. How long can you afford to tie up capital? Often, a longer holding period provides a higher return, assuming the investment performs as expected.

- Taxes. Non-traditional investments are taxed differently and often require the filing of a Schedule K-1 with the IRS. We can advise you on what tax reporting will be required and when, including taxes on stock issued to you by an employer.

- Impact. We can present options for direct investment in private markets that align with your goals for the environment and your communities, such as ventures in renewable energy, affordable housing or neighborhood revitalization.

- Family circumstances. Your life and that of your family members is likely to change over time. What happens to ownership of your private market investment if you get married or divorced while those assets are tied up? What happens if you become incapacitated or pass away? We’ll help you think through titling, community property issues and estate planning considerations of these unique investments.

Expanded Opportunities

Depending on asset size and circumstances, we can help you expand you portfolio beyond traditional investments into asset classes and opportunities most retail investors cannot access on their own. Over time, we have developed a network of relationships and due diligence capabilities that allow us to source opportunities in a variety of sectors and strategies.

Private Equity

Specialist skill and access to differentiated return potential

- Venture Capital

- Growth Equity

- Buyouts

- Secondaries

Real Assets

Tangible investments with cash flows that can protect against inflation

- Public/Private Real Estate

- Public/Private Infrastructure

- Commodities

- Natural Resources

Diversifiers

Enhanced diversification and anchoring during periods of market stress

- Multi-Strategy

- Long-Short

- Absolute Return

- Statistical Arbitrage

- Event Driven

- Arbitrage

- Private Credit

Deep Due Diligence & Expertise

Our investment team has decades of experience analyzing investments in the private markets, real assets and hedge funds and managing the risks involved. We are extremely selective in the investments we choose, researching many promising opportunities and rejecting most.

We are not beholden to any one private equity firm or hedge fund. And we are keenly aware that with the benefits there are also the downsides of investing in private markets and hedge funds, including higher fees, lower transparency, potentially higher taxes and lack of liquidity.

We will propose such investments only when we are convinced the benefits to your portfolio will outweigh the risks, and after each investment proposal has been thoroughly researched and vetted through our due diligence process.