Impact INVESTING

Invest for impact

profitably

profitably

LNW’s team can help you use impact investing to earn a return on your investments and generate positive impact that matters to you.

Impact Starts with You

At LNW, impact investing is a portfolio strategy that is driven by what you care about and the type of impact you want to have.

Guide to Impact Investing

If you are considering incorporating impact investing into your portfolio for the first time or are looking to broaden your existing impact focus, our guide looks to help you deepen your understanding and grow your confidence in the power and value of impact investing.

Investing Can Do More Than Build Personal Wealth

It can be a powerful tool to improve the world we live in. At LNW, we believe you can achieve both. We call the intersection between your financial goals and those you have for our communities and the environment impact investing.

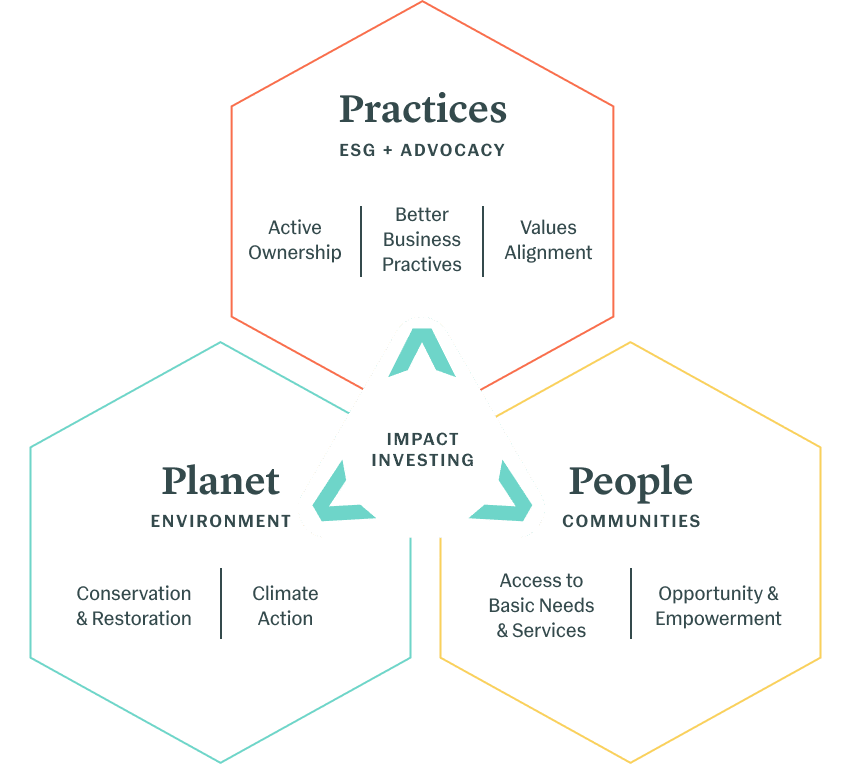

There are many different ways to invest for impact, including responsible investing, ESG (environmental, social and governance) integration, thematic investing and catalytic investing.

Like the rest of our work for you, impact investing is a highly customized process. Regardless of which strategies will work best for you or if you employ one or many, they all serve a bigger purpose: activating your portfolio to achieve your financial goals while prioritizing the environmental and social issues you care about most.

LNW Impact Investing Strategy

Your Goals / Our Expertise

We help you crystallize and prioritize the social and environmental challenges you want to address in context of your overall wealth plan, which we design to achieve your financial, non-financial and impact goals.

Customized Strategy

We develop a customized impact investment strategy to meet your impact objectives. Many impact themes are interrelated and can include climate change, opportunity & empowerment, financial inclusion and improved access to quality education, affordable housing and healthcare.

Total Portfolio Approach

Your impact objectives are not separated from your financial goals. We create portfolios that work on both levels – impact and financial return – using a variety of asset classes in both the public and private markets (private equity and venture capital, private debt and real assets) to optimize risk, return and impact for your unique needs and aspirations.

Journey We Take Together

We guide you through the shifting landscape of impact investment opportunities, while sharing our own learning and client best practices. Your strategy is iterative and flexible, evolving over time to reflect new opportunities and developments at the forefront of impact investing.

Built-in Monitoring and Reporting

We provide in-depth, customized impact reporting on your impact investment strategy. We monitor your investments and check with you regularly on changes to your impact goals.

LNW Impact Investing Principles

We seek to identify those opportunities where the impact strategy drives investment value.

-

No Compromise

We believe that impact investing can serve to reduce risk and/or enhance returns. It does not require us to accept a sub-par risk/return profile. Impact considerations such as climate change and social justice are increasingly relevant to asset pricing, creating many new investment opportunities and risks.

-

Holistic Alignment

We look for impact alignment in business practices and operations and hold ourselves and the asset managers we work with to best-in-class environmental, social and governance standards.

-

Impact Management

We think impact measurement and management can be used to improve both impact and financial returns over time. We seek to deepen our collective impact by using our investor voice to support progress.

-

Evolution

We do not believe in making the perfect the enemy of the good; we believe in getting started and pushing to broaden and deepen impact as the market evolves.

How We Align Our Impact Objectives

The impact objectives that inform our impact investing offering are mapped to the United Nations’ 17 Sustainable Development Goals (SDGs), a set of collective targets to build an inclusive, sustainable and resilient future for people and planet. The SDGs are fast becoming the global impact investment framework.

Sign up for impact emails and reports

With this sign up you will receive our quarterly impact digest, annual impact report and annual shareholders report.

"*" indicates required fields