In 2020, because of the great needs caused by Covid-19 and also because of a 2020-only tax break, the best holiday gift to charities might be cash. Here are some key things to know about this tax break, which LNWM’s Kristi Mathisen and Carla Wigen discussed via webinar last week.

This is a federal tax break that was in the CARES Act passed this past spring to offset Covid-19 economic hardship. It has temporarily changed the rules of how much you can deduct for cash donations to charity.

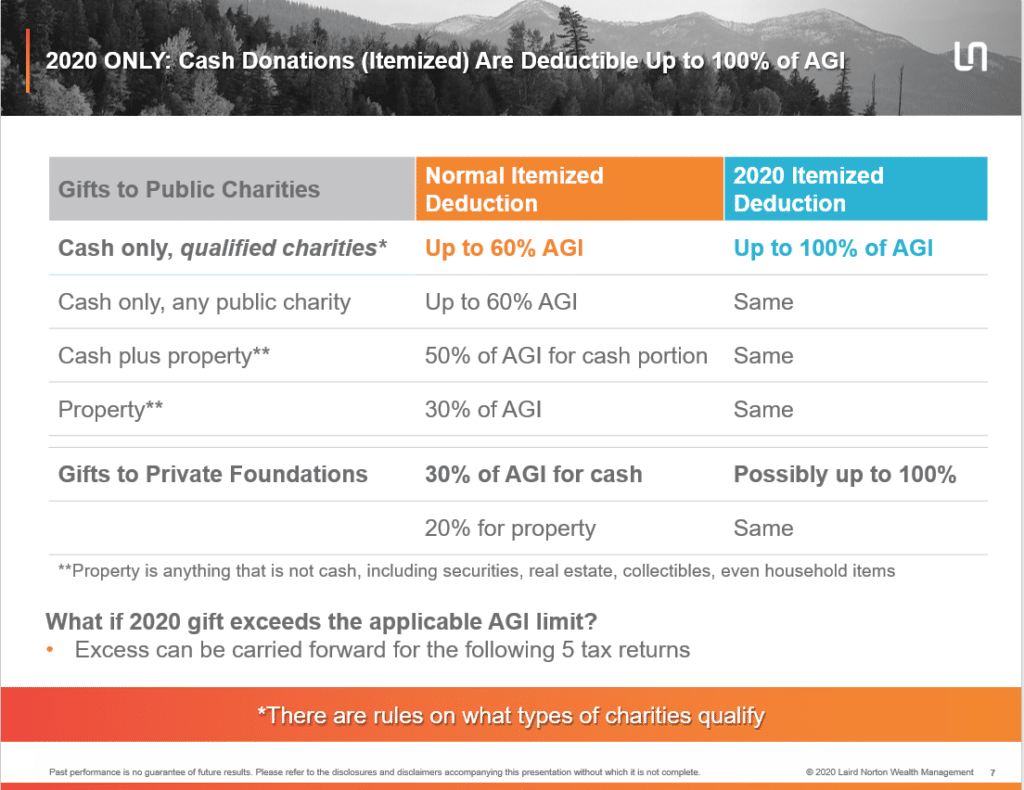

In 2020 — and only in 2020 — giving cash to charities can reduce the donor’s adjustable gross income, or AGI, by up to 100%. Example: a $50k gift to charities by the end of December 2020 can reduce your AGI by $50k.

Who Qualifies

- You must itemize your deductions in order to be eligible (those who opt for the standardized deduction cannot do this).

- Gifts must be in cash and must go directly to a qualified charity, NOT a donor-advised fund (DAF) or a supporting organization.

- Cash donations more than 100% of your AGI can be carried forward for five next tax years and deducted at 60% rate.

Watch Out for These Pitfalls

- You might actually be better off donating appreciated stock or other property to charities, saving yourself the capital gains taxes. This requires analysis of giving strategies based on personal financials.

- Beware of bringing in more income into your 2020 return so you can deduct it, without thinking this through. As Kristi and Carla pointed out, higher income in 2020 can end up lowering certain other deductions, increasing Medicare Part B and D premiums, and qualifying you for the Net Investment Income tax.

LNWM advisors are strategizing with our clients interested in large year-end donations — the size and type of possible gifts and resulting impact on finances and taxes. This year especially, it is often preferable to break up donations into several different gifts to maximize the proceeds to charity while leaving more options open for minimizing personal taxes.

For more details, view last week’s in-depth webinar by Kristi and Carla on the 2020-only tax breaks. Please note: to again webinar access, password is 35Dmq9Kp.