Q&A: Impact Investing Applied

Q&A with Justina Lai

As wealth advisors to families and foundations over many generations, we are committed to sustainable, resilient and equitable economic growth as opposed to short-term growth at all costs. We therefore continue to strengthen our capabilities in impact investing, which strives for environmental and social benefit as well as financial return.

Leading this effort is Justina Lai, Chief Impact Officer. We sat down with Justina for an in-depth discussion about how impact investing is conducted at LNW to help each of our clients achieve their goals.

Justina: For many people, including our clients, impact investing is driven by personal values and a desire to drive positive change. But for us, while generating impact is important, impact investing is first and foremost an investing discipline.

Some clients are not explicitly focused on investing for impact, but we still believe they can benefit from managers with the expertise to understand the risks and opportunities that environmental, social and governance (ESG) issues present to shareholder value.

We believe asset managers incorporating impact into their investment process can reduce portfolio risk and enhance returns. Impact issues such as climate change are increasingly relevant to asset pricing, creating many new investment opportunities and risks. Just as important, we think companies that operate in a sustainable manner have lower operational risk.

Justina: As I mentioned, all our client portfolios benefit from ESG and impact considerations being part of our investment due diligence with the objective of maximizing the risk-return profile.

In addition, for those clients that want to proactively invest for impact, we can and do seek out those investment opportunities where an impact strategy is driving the investment thesis. Beyond that, there is a great deal of variation in how our portfolios are structured since we aim to optimize for all of a client’s goals – financial, non-financial and impact.

Justina: I would say there are five key differentiators.

1. Impact strategy. We work with our clients to articulate, develop and execute upon an overarching impact investing strategy. This can include a “theory of change” focused on specific impact goals. All the while, we ensure that we are adhering to their other goals and their portfolio’s financial targets – diversification, risk, return and liquidity. So it’s a total portfolio approach and process.

2. Implementation. Our history in impact investing and the scale of our operations allow us to continually expand the depth and breadth of the impact strategies available to our clients, as well as the investment vehicles used to execute those strategies, including separately managed accounts (SMAs) and private funds.

3. Impact reporting/management. We provide detailed and customized reporting to our clients on how their impact strategy is being executed and the results, using both qualitative and quantitative impact metrics. I think the depth of this reporting is quite unique in our industry and something we will be rolling out for all clients in the coming year. We also manage our clients’ portfolios for broader and deeper impact, actively engaging with our managers and others to make collective progress on ESG, DEI and climate action.

4. Shareholder advocacy. We are likely one of the most active wealth managers when it comes to enabling our clients to support shareholder proposals. For the 2023 annual meeting season, for example, our clients have signed over 700 authorization letters to file, co-file and support 95 shareholder resolutions. [See our latest Shareholder Resolution Impact Report.]

5. Integrated impact. We seek impact alignment with the asset managers we work with including their business practices/operations and how investment decisions are made and by whom. This extends to our own firm: Impact considerations are integrated into how we engage with each of our stakeholder groups (clients, employees, owners and the communities we operate in) and our internal activities (investment management, client services, and operations).

Justina: I think it’s most effective to invest through a combination of strategies and approaches across asset classes. In general, these include:

– Investing in companies with better ESG business practices and transitioning to more sustainable business models;

– Investing in businesses with products and services that address fundamental social and/or environmental challenges;

– Using stewardship, engagement and shareholder voice to push for change.

The kind of impact as well as the depth and breadth of that impact varies by approach and by objective and has limitations.

Justina: We recognize that passive investing via various ESG index strategies is limited in its impact because it is based largely on broad, third-party ESG ratings rather than fundamental research.

Despite the limitations, we believe ESG indexing can still play an important role by providing low-cost, broad market exposure, particularly to the more efficiently priced asset classes, while still allowing clients to tilt toward “better” companies and away from those with egregious practices. Where possible, our clients can then have further impact by voting their proxies and supporting shareholder resolutions with the companies in which they invest.

Beyond that, to have deeper impact, we incorporate actively managed funds that conduct fundamental ESG analysis and serve as active owners. All of our actively managed strategies engage with their portfolio companies and incorporate “inside-out” analyses to understand how a company’s operations are impacting society and the environment. In addition, we invest in public and private market funds that target specific environmental and communities-based themes.

In many cases, our clients’ targeted impact goals can be met directly. But, in other cases, a broad-based approach to creating impact might be more financially prudent (in terms of liquidity, optimal diversification, etc.). It’s why we take a total portfolio approach – acknowledging that different parts of a client’s portfolio will likely have deeper, more targeted impact than others. We believe that, ultimately, many impact themes are interrelated and inextricably linked, such that most of our clients’ impact investments can directly or indirectly contribute to their impact goals.

Justina: As a firm, we use ESG third-party data and ESG scores to identify potential areas of focus but not to drive investment decisions. For each strategy, we rely on our due diligence and impact investing experience to better discern the authenticity, quality and effectiveness of an asset manager’s approach to generating impact. And this includes a critical look at how managers are using ESG data and ratings to make decisions.

We are encouraged that the SEC is currently working on requirements for U.S.-listed public companies to provide in-depth disclosure on ESG and climate risks, as greater standardization will offer greater transparency and access to additional material information to our firm and our managers.

Justina: Understanding net impact is imperfect and challenging. Impact investing requires an understanding of which ESG/impact considerations are the most material for a particular company operating in a specific industry.

Tech companies, for example, spend a lot of time talking about their strong environmental performance and net-zero initiatives. While important, it is poor performance on social factors, such as job quality standards or user privacy concerns, that can make tech companies less competitive in the long run because they may not be able to hire the best and brightest or users might defect.

In our due diligence, we delve into what our managers prioritize in their decision-making including to what extent, and how consistently, they incorporate financially material ESG/impact considerations into their analyses and how they vote their proxies and engage with the companies they invest in to improve ESG/impact performance.

Corporate Social Metrics

Some Examples

- Hiring and promotion practices

- Job training programs

- Paid sick leave and paid family leave

- Pay equity

- Product safety

- Providing underserved communities with access to products and services

- Worker health & safety

- Worker pay/benefits

- Workforce and board diversity

Justina: Not necessarily, as there is an increasing amount of information available (see box). These are all factors that affect a company’s long-term competitiveness in attracting and retaining workers, increasing worker productivity, boosting the brand and gaining market share or creating new markets.

Companies in a many different sectors – including financial services, healthcare, real estate, education – can potentially tap into massive markets with little competition by developing much-needed, high-quality and affordable products and services for underserved populations. That is both a benefit to communities and to a company’s bottom line.

We think it is critical to understand impact at the systems-level and recognize that social and environmental impacts are inextricably linked. For example, minority and low-income communities are much more likely to live adjacent to and downstream from toxic byproducts and pollution. We believe there are investment opportunities in enabling a just transition from an extractive economic system toward one that is regenerative.

Justina: Currently, divesting has little incremental impact on the cost of capital, so it does not have

a meaningful effect on real investment decisions. While it is critical to invest proactively in climate solutions, we also know that it will be incredibly difficult to achieve climate goals unless we are successful at pushing the largest and most egregious polluters to transition.

Instead of divesting, we believe in investing selectively and using shareholder engagement to push for reductions in real economy emissions at scale. Selectivity is key. There are large differences between companies actively funding climate science denial and those investing significantly more in renewable energy than in oil & gas operations. The laggards in adopting new technologies and markets are not well-positioned to compete in the future low-carbon economy. Eventually, they will see their dominance erode and face significant transition and stranded asset risks.

“Impact investing requires an understanding of which ESG/impact considerations are the most material for a particular company.

Are you optimistic about efforts to combat climate change?

Justina: While it may not seem like it, progress is being made. Instead of being optimists or pessimists, we need to be determined and continue to emphasize the urgency. I think clean technologies have reached a tipping point, reflected in major milestones in energy transition investments.

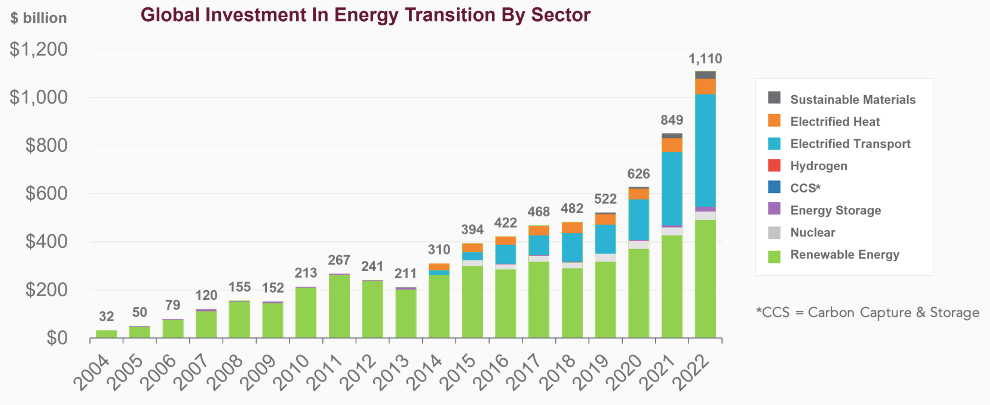

Last year, for the first time ever, the amount of new investment in the energy transition equaled the amount invested in fossil fuels: $1.1 trillion. Renewable energy, electrified transport and six other energy transition sectors all set annual investment records in 2022. (See chart above.)

With that said, I think it’s all-hands-on deck as this transition will require a business model and economy-wide transformation. We have a short window of opportunity to deploy a whole ecosystem of approaches to be effective, so we’re seeing lots of innovation in climate mitigation but also now an increasing focus on adaptation — particularly in the emerging markets where many of these climate impacts are already being felt.

Justina: Unfortunately, I think that the challenges to ESG and impact investing will continue to dominate headlines and generate media attention. In some ways, I think it’s an indication that impact investing has grown enough and has achieved enough mainstream success to become a target. However, we don’t think legislators ultimately will be able to stand in the way because investors, and especially fiduciaries, cannot deny the financial materiality of ESG and impact-related risks and opportunities. These are truly material issues that can be a source of innovation and competitive advantage for the U.S.

About Justina Lai

JUSTINA LAI is Chief Impact Officer at LNW. She leads the firms’ impact investing strategy, guides efforts to create shared value for all stakeholders (clients, owners, employees, communities and the environment) and spearheads diversity, equity and inclusion initiatives. Justina also supports the client service teams as they develop effective impact investment strategies and integrate impact investments across client portfolios. Justina holds an MBA with certificates in Global and Public Management from Stanford University’s Graduate School of Business and a B.S. in Finance and International Business, summa cum laude, from New York University.

Laggards in adopting new technologies and markets are not well-positioned to compete in the future low-carbon economy.