We create for each of our clients a strategic business plan for investing that brings vision, structure and discipline to the preservation and growth of capital, often over multiple generations.

When you hire LNW, you are hiring a distinct investment philosophy with these tenets:

- Goals-Driven and Pragmatic. We have a singular focus: To maximize the probability you will achieve your financial and non-financial goals in the real world using real dollars (net of taxes, fees, inflation). We assess portfolio progress and vulnerability in context of where you are now and what you want to accomplish (not just in abstract financial terms).

- Focus on What We Can Control. Markets are unpredictable and results uncertain, while attempting to time the markets is humbling and flawed. We therefore devote our energy and expertise to factors that increase the probability of successful portfolio outcomes, including: goals-based asset allocation; investment vetted by in-depth due diligence; and the astute management of taxes and fees.

- Long-term, Nimble Positioning. We work to know you and your circumstances from the very start of our relationship. This allows us to build portfolios that meet your needs and are aligned with your goals through full market cycles, including periods of intense volatility. All the while, we pay careful attention to changing market dynamics.

- Returns Are an Outcome of Risk. We believe focusing on risk first is the key to long-term investment success. We work to understand, calibrate, and get compensated for the many dimensions of risk embedded in your portfolio. Our aim: to take on risk commensurate with the return required to achieve your goals.

- All Investments Have Impact – Positive and Negative. We believe environmental and social considerations are material factors when underwriting an investment. Along with many other factors impacting company performance and profitability, they can lower investment risk and/or enhance return, while creating shared value for all stakeholders. This is not a values-based approach but simply smart investing.

When you hire LNW, you are also hiring a distinct decision-making process with the following underpinnings:

- Perspective. We place very little weight on Wall Street forecasts and media reporting. Based on multifaceted data analysis and research, including input from the asset managers we work with, we attempt to understand what is happening in a historical context and the unique aspects of current circumstances. This allows us to drown out the noise in managing portfolios.

- Third-Order Thinking. We avoid simplistic cause-and-effect analysis: A is happening because of B. Instead, we consider the variety of scenarios that can arise from current developments (2nd order thinking), and we set our course based on the longer-term repercussions of the most likely scenarios (3rd order thinking).

- Recognition of Cognitive Bias. One of the greatest detractors to investment success is human bias. We therefore apply behavioral finance — the study of how emotions and cognitive biases can distort sound investment decision making — to every facet of our work. We consistently seek to detect and mitigate bias in decision-making, including within our investment team, the asset managers we work with, as well as in our clients’ thinking.

CLOSER LOOK: How We Deliver on Our Tenets

1. Real World Goals-Driven and Pragmatic. We invest your capital based on a deep understanding of your circumstances. This includes assets you own now and are likely to own in the future, your tax profile, current cash flow and future funding needs, tolerance and preference for risk, constraints, opportunities available only to you, and if applicable, the desire to invest for environmental and social impact. All these factors combined create a rationale for investing that is unique to you and which is reflected in what we call your business plan for investing: the portfolio(s) we design for you, targeting each of your goals in actual dollars (net of fees and taxes).

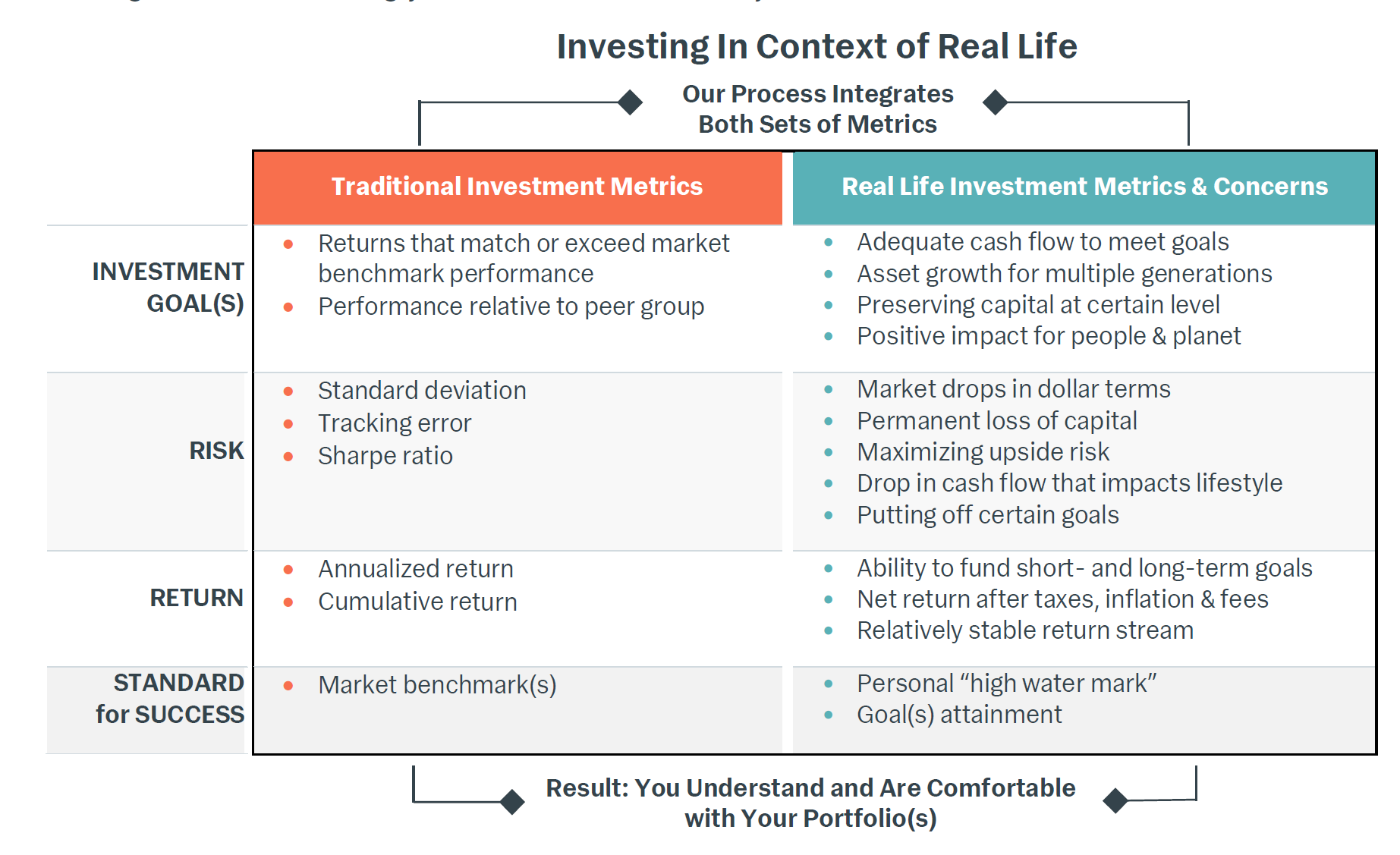

Investors can get overly focused on short-term performance relative to benchmark. Our investment team uses benchmarks as an important way to evaluate the performance of underlying investment strategies in your portfolio. However, the true metric of portfolio success is goals-based. We gauge success by how well your assets and portfolio strategies are supporting your real-world goals and addressing your real-life concerns.

2. Focus on What We Can Control. While markets are difficult to predict and results uncertain, the benefits of a comprehensive and disciplined investment plan are known and enduring. By focusing on levers over which we can exert some degree of control, we aim to narrow the dispersion of potential portfolio outcomes over time, thus maximizing the probability of achieving your goals.

As you can see in the graphic below, there are many levers that we can pull to improve the probability of successful portfolio outcomes. The most important lever is the appropriate strategic asset allocation (SAA) – relative to your goals, needs and current financial circumstances. The SAA is geared to provide necessary liquidity/cash flow, growth required to achieve strategic goals, and levels of risk you can, should and want to take. Additionally, regular rebalancing to that asset allocation (i.e. trimming exposures at or above target and adding to those at or below target) is widely known to be accretive to wealth compounding over time. Two other levers involve minimizing the amount of dollars going to taxes and investment management fees.

As we build your portfolio, we are focused on incorporating a broad range of risk factors, or drivers of return, rather than just including a wide array of asset classes that may correlate at exactly the wrong time.

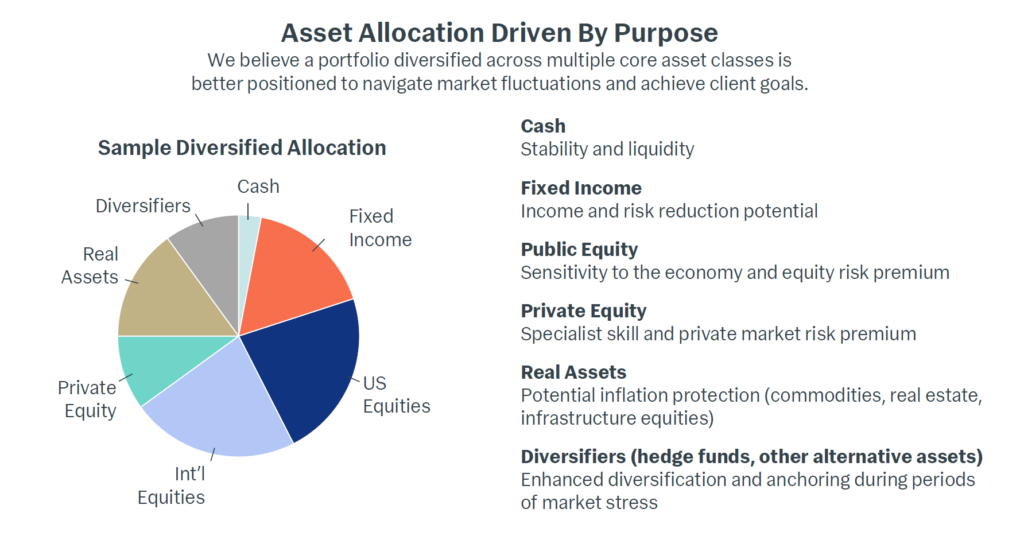

3. Long-Term, Nimble Positioning. Maintaining a long-term perspective is crucial, but adapting to markets is also important. We create portfolios that can meet your needs and support your goals through full market and economic cycles, your lifetime, and possibly over many generations. We populate portfolios with a diverse set of what we call “ingredients” (i.e. asset classes and investment strategies) that respond to market developments differently — including private market investments, real assets and a category we call diversifiers, which exhibit a blend of equity and bond characteristics. When appropriately combined, these different ingredients can offset and augment each other, creating resilience through bull and bear markets.

The long-term strategic asset allocation for your portfolio is the cornerstone of your business plan for investing. In addition, and when appropriate, we seek to populate your portfolio with strategies that have exhibited nimbleness through entire market cycles. They do that by minimizing risk when the market environment or their investment universe seems overvalued and taking advantage of opportunities when many investors are fleeing risk assets.

We do not let ourselves get distracted by daily volatility, as too frequent portfolio tinkering elevates decision risk (i.e. more decisions increase the risk of making a sub-optimal one).

4. Returns Are an Outcome of Risk. We consider risk in all its forms and in relation to your goals, including volatility, capital loss, lack of stable cash flow, stagnant growth, the erosion of purchasing power (inflation), fraud, and the risk of cognitive bias or emotions negatively impacting decisions. Our aim is to maintain portfolios with risk levels that are appropriate for your circumstances and the targeted wealth accumulation necessary to pursue your goals. Our diversified approach intends to limit the severity of difficult markets in context of a long-term investment horizon, allowing your portfolio to benefit from the power of compounding over time to generate the return needed to achieve your goals.

Starting with the risk equation does not mean being risk-averse. For whatever level of risk you are willing, able, need or desire to take, we analyze the components of that risk and whether you are being adequately compensated for that exposure. Our role in the client-advisor relationship becomes especially important during turbulent market cycles, when we work with you to mitigate emotional decision-making that can derail decades of wealth accumulation.

5. All Investments Have Impact – Positive and Negative. We include environmental, social and governance (ESG) factors in our investment analysis because we believe these factors can be accretive to portfolio outcomes by either minimizing corporate risks or enhancing return on capital. We do not approach the incorporation of these factors as a values-based approach but simply smart investing on par with evaluating factors such as currencies, interest rates, inflation, business trends, secular themes and geopolitical risks.

In addition, if you would like to activate your portfolio for impact because you have specific issues areas you would like to target, we will seek investment opportunities where an impact strategy is driving the investment thesis. All the while, we ensure that we are adhering to your portfolio’s financial targets, in terms of diversification, risk, return and liquidity.

IN SUM: Our purpose at LNW investment management is to help you achieve the multi-faceted goals (financial and non-financial) that arise from your life and circumstances. We do not pursue abstract, relative-to-benchmark returns with little to no focus on the inherent risks. Our investment philosophy therefore centers on the disciplined construction of portfolios that reflect your unique situation and leverage our experience knowing what we can (and cannot) control, coupled with a deep understanding of the multiple dimensions of risk. By making your needs and goals a key input into our investment process, we increase the likelihood of achieving your goals in real dollar terms, our utmost measure of success.