Thirty Trillion Dollars. That’s how much the Millennial Generation – now in their late teens to early 30s – are likely to inherit collectively from parents (the Baby Boomers). While there are differing opinions about Millennials – ranging from “self-absorbed” to “great problem solvers” – nobody can deny that Millennials — now the largest generational wave in the U.S. — will have a big impact on family, the workplace and society.

So, the $30 trillion question is: How can you relate to the Millennials in your life? What makes them tick? Being a Millennial myself, here’s what rings true to me based on my review of recent research.

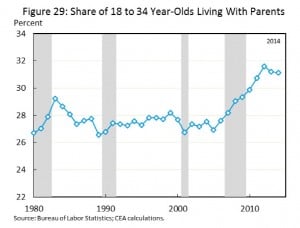

#1. Millennials take longer to do things parents care about most: finishing school (why not a gap year?); getting a job (grad school for sure!); finding a place to live (why not the family home?); marriage (haven’t found “the one”); and having kids (need to get established first).

If you stop to think about it, this make sense. Since 2000, there’s been greater economic and geopolitical turmoil, compared to the 1990s. Growing up in a world with more uncertainty – a tough jobs market, high real estate foreclosures and record student debt – is it any wonder that we tend to prefer to stay longer in school, take longer to find a job or postpone making major financial commitments?

If you stop to think about it, this make sense. Since 2000, there’s been greater economic and geopolitical turmoil, compared to the 1990s. Growing up in a world with more uncertainty – a tough jobs market, high real estate foreclosures and record student debt – is it any wonder that we tend to prefer to stay longer in school, take longer to find a job or postpone making major financial commitments?

Still, you can take comfort in that most Millennials are pretty traditional at heart. Nearly 70% of Millennials say they plan to get married eventually. And 90% of us plan to own a home.

The notion that Millennials tend to job hop more often is also not true. The reality: Once Millennials have a job, they tend to stay at it as long or longer than the Gen Xers (the previous generation) did at the same age. This and other very interesting findings are in 2014 report by the White House Council of Economic Advisers: 15 Economic Facts About Millennials.

#2. Love to multi-task. At home or at work, you might have to try harder to keep the Millennials around you tuned in and engaged. This probably has something to do with the 18 hours a day, on average, that Millennials spend reading, viewing or responding to media. Add in six hours of sleep, on average, and the day is over! Granted, much of that media exposure is indirect, but still. Is it any wonder we need more time to decide where to eat, let alone where to live and work (#1 above)?

#3. Seek out experts. Millennials would rather pay an expert to do a job than do it themselves. It’s faster, easier, less stressful, and usually turns out better. Millennials apply this principle much more liberally than previous generations, and we tend to pick our experts based on what friends have to say. Convenience plus expert advice have fueled the success of services like Bombfell, which ships a few clothing items to men each month for them to consider buying.

#4. Pay up for what matters. Studies show that we Millennials are willing to pay more for things that are important to us, assuming we can manage the payments. In other words, if a Millennial is a big believer in well-designed electric cars, she’s more likely to buy a Tesla vs. a Ford, as long as the monthly payment doesn’t break the budget.

#5. More risk-averse. Millennials grew up during the Great Recession and largely blame Wall Street for the fallout. A 2014 Wells Fargo survey found that a third of Millennials have most of their retirement savings (more than 75%) in things other than stocks or mutual funds. And another 25% of Millennials weren’t sure where they’re invested. That is pretty shocking: Over half of Americans now in their 20s and early 30s are wary or unaware of the benefits of equities as a good long-term investment!

Of course, the above are just general trends, and don’t apply to all Millennials—in fact, I take exception to many of the statistics applied to my generation. But what I see in all these results is the underlying tendency to avoid financial risk. Even though Millennials say they favor ever faster, more efficient processes, they tend to be OK with a relatively low return on investments, as long as that return is guaranteed. Ironically, extreme risk-averseness can make long-term financial goals harder to achieve.

Here at LNWM, we’re well aware that too much caution can be as problematic as too much risk. Finding the right balance is key and a big focus of what we teach in our NextGen Money presentations.