As wealth advisors, we are continually aiming to expand the opportunity set for clients, meaning finding and proposing investments that offer atypical sources of return. Increasingly, an area of focus for us is private market investing, as we foresee lower average returns in the public stock and bond markets given current valuations and global growth concerns.

Private investments are just that: any investment that is not publicly traded. Many of our clients already have significant stakes in the private markets through ownership of a closely held business, investment real estate or other assets. For them, as well as clients invested solely in the public markets, we assess how diversification into different types of private market investments can benefit their portfolios, given the following:

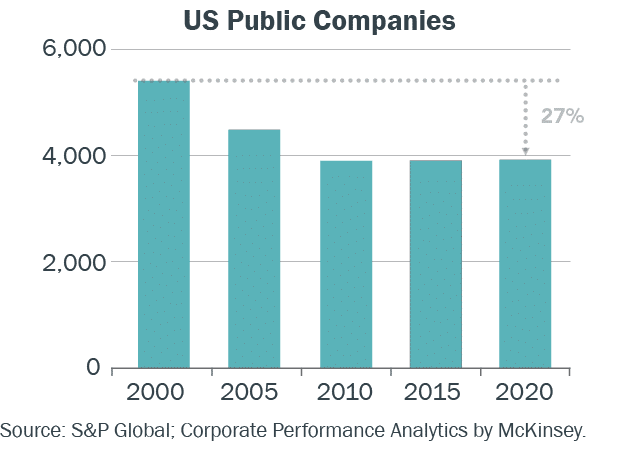

Public markets are offering less diversification than in the past. As the chart below shows, there were roughly 27% fewer publicly traded U.S. companies in 2020 than in 2000 (and close to 50% fewer than in 1980), even as the total value of publicly traded stock has risen significantly, to 150% of GDP (see chart on next page). There are many reasons for the “fewer and bigger” shift in the U.S. public equity markets. For one, industry consolidation. Just as key, not as many companies are going public via Initial Public Offerings (IPOs), since funding is readily available from venture capital groups and private secondary offerings. In most major sectors, there have been fewer IPOs since 2000 than exits (sale of company shares to other investors in the private markets), resulting in more of the gains in equity valuations going to private market investors.

Increasing number of opportunities in the private markets. Many more companies are attracting private equity investment, and new money flows into all private markets increased steadily from 2013 through 2021. This money has not just gone into private equity deals. Investment in private market bonds and other private debt has also risen substantially, offsetting banks as a source of funds.

In fact, private debt, natural resources and infrastructure have seen the fastest growth among private markets in the past five years.

Much greater dispersion of returns in the private markets. This is to be expected since there is greater diversity in the quality and quantity of private investments, which is particularly true for private equity investments. As the chart below shows, the distribution of returns for private global equity funds from 2012 to 2022 ranged widely — from +3.6% to +26.3% — significantly more than the narrow band of returns for publicly available global equity funds.

Concentrated ownership with long-term focus. Investments in the private markets are often illiquid – capital is committed for five to 10 years. This makes it possible to invest in ventures that are not currently profitable and/or cannot be sold quickly but which could generate attractive returns over a decade or so. By contrast, public markets are usually highly liquid but focused on the short term, with significant investor emphasis on quarterly earnings and meeting shareholder expectations. Less likely in the public markets are long-term strategies that create value but in the near term can put a strain on financials (lower profits, diluted earnings, higher debt levels, etc.).

Potential alignment with personal values, interests and preferences. Because of the wide range of investments in the private markets, there is more opportunity to focus on specific areas of interest, especially if you want to have your investment to benefit society or the environment, such as funding to produce renewable energy or affordable housing.

Key Considerations

At LNW, we research and seek out private market investments with attractive risk/reward profiles — including private equity funds, growth capital/venture capital, private real estate, private infrastructure, natural resources, distressed debt — while also helping clients evaluate private investment opportunities in context of everything else they own.

Below are key considerations before proceeding with any private market investment. Helping clients see how an investment aligns with their goals, finances and wealth plan is just as important for us as finding the right investment in terms of risk and return.

Liquidity

As mentioned earlier, private investments require that you commit capital for an extended period of time, an average of five to 10 years. This makes private investing “illiquid” by definition. While you could potentially sell your shares in a secondary offering, those transactions are complex and the number of buyers limited, possibly resulting in steep discounts to intrinsic value.

We do not think lack of liquidity translates into higher risk, unless: (1) The level of due diligence on the investment is sub-par. Here at LNW, we apply an even higher level of screening and vetting to private investments given the lack of public data available and the long-term commitment of capital. We do not invest unless we have strong conviction about the management team and their investment plan.

(2) Your need for liquidity was miscalculated. Getting an accurate estimate of your liquidity needs requires an in-depth income sustainability analysis for the next several decades, considering all likely expenses and aspirations, so that you feel confident you can live the life you want without access to the money tied up in the private investment(s). After conducting an income sustainability analysis for many different life events and scenarios, we often find that clients actually have more liquidity than they think (even with a large buffer for unexpected events); therefore, they are financially able to capture the “illiquidity premium” provided by private markets.

Some positive aspects of illiquid investments: You will not be able to act on the urge to sell during market downturns, which often results in locking in losses. Also, private fund investments happen in stages, as the general partners raise capital for new investment. These capital calls can provide a natural “average-in approach” to investing. Similarly, private funds seek to sell portfolio investments when attractive opportunities arise, providing a natural sell discipline. During market downturns, the General Partners of well-positioned private funds are often able to take advantage of lower prices with their “dry powder” ─ funds raised but not yet invested.

Taxes

The money you invest in private markets is taxed according to the type of entity you invest in. Some private market investments, such as angel financing for a startup, provide a tax advantage if they do not generate income or dividends annually, and you pay a long-term capital gains rate when you sell, which in certain cases can be eliminated if the shares you were allotted are Qualified Small Business Stock (QSBS).

However, most private funds are set up as Limited Partnerships or Limited Liability Companies, which are required to report annually your portion of income generated, whether or not it is distributed. Usually, that reporting is done via a Schedule K-1, which is issued to you to report on your federal tax return. While K-1s can be cumbersome, we have experience integrating them into our client’s investment tax reporting.

Family Circumstances

What happens if you get married or divorced during the time that your money is tied up in a private market investment?

It is important to know (and prepare for) the rules of community property and how those would apply. In nine states, including Washington and California, whatever investment is made

during the marriage belongs to both spouses equally, with few exceptions.

Estate Planning

What happens to your private market investment if you pass away? There are many trust and estate planning strategies you can use to specify what happens to your assets, including private market investments, while increasing tax efficiency and privacy. For instance, you could specify in your will that upon your death, your private market investment will be placed in a trust for certain family members and/or organizations, and you can specify the terms under which the trust would disperse the assets.

Context is Key

We believe private market investments can enhance the overall risk/return profile of portfolios over time. That’s because an increasing number of investments are now offered in the private markets, sometimes at attractive valuations; the managers of private funds are incentivized to invest for the long term and in-line with investor interests; and the managers often have more leeway to take advantage of market downturns, since they do not have to address investor withdrawals. As always, the devil’s in the details. This is why we dig deep to assess how a private market investment will work in terms of risk and return and also how it aligns with each client’s finances and life goals.

Are You Qualified or Accredited?

Because private investments are not required to register with the

SEC (Securities & Exchange Commission), investors in private market funds must meet certain net worth thresholds. Depending on the fund, there are two levels of qualification:

Qualified Purchaser – Someone who owns more than $5 million worth of investments.

Accredited Investor – Someone whose net worth (excluding primary residence) is higher than $1 million, or whose earned income is above $200,000 a year ($300,000 if married) for at least the past three years.

Note that qualified or accredited investors can be individuals, an existing family-owned business or a trust set up by qualified or accredited investors. If a business or a trust, that entity cannot have been formed for the specific purpose of investing in the private fund. Rules and criteria for businesses and trusts may differ; we advise clients to contact their LNWM advisor with any questions.