“Higher for longer” has been our thesis for U.S. interest rates since the start of 2022. U.S. inflation spurred by years of low interest rates, new tariffs, higher government spending and pandemic-related fiscal stimulus had led to a new interest rate regime, away from historically low rates.

The Federal Reserve is expected to cut its key interest rate (the Fed funds rate) twice in 2025. However, we do not think a return to the near-zero rates that prevailed from the 2008 Global Financial Crisis until 2022 is likely any time soon. The reasons include geopolitics, shifts in global trade/tariffs, and aging populations in the developed world.

As investors, we had to ask: What are the implications for the markets when interest rates remain higher for longer?

Specifically, we wanted to examine whether actively managed investment strategies have historically had an advantage over passive strategies (those that closely track an equity index) during periods of normal to high interest rates.

Research Parameters

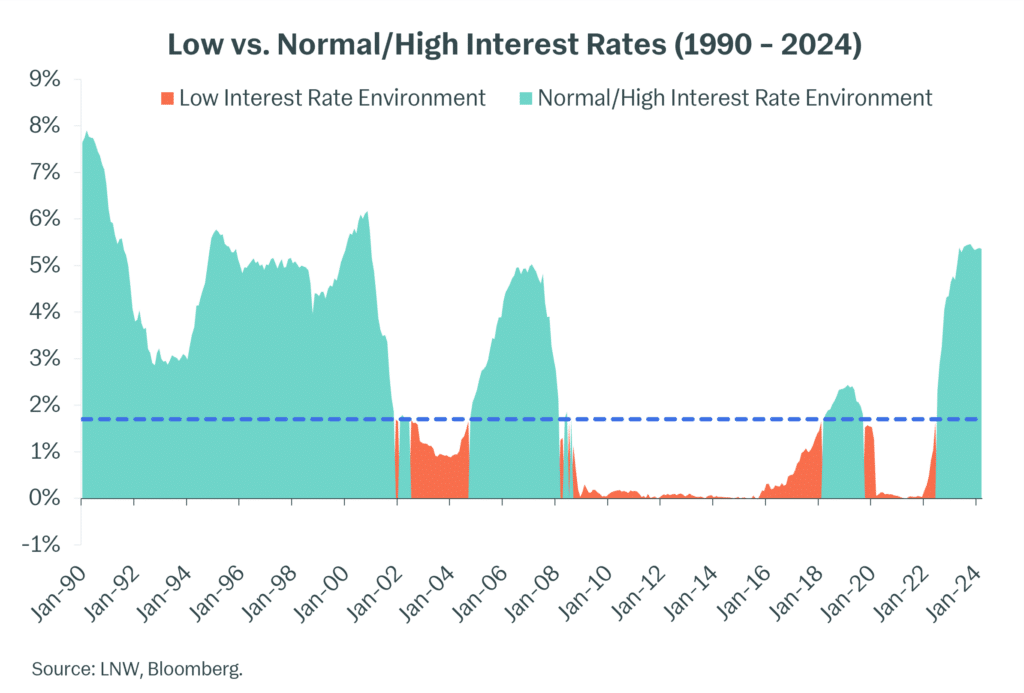

Going back 34 years (from January 1990 through March 2024), we labelled periods according to the general level of prevailing U.S. interest rates: either low or normal/high. Our proxy for interest rates was the yield on three-month Treasury bills, which approximates the Fed funds rate (the rate that the Fed controls).

The median T-bill rate over this 34-year period was 1.7%. And we used that as the dividing line to distinguish between “low” rates (below 1.7%) and “normal/high” rates (1.7% and higher). As you can see from the chart below, since 2009 we have experienced mostly low interest rates although now we are decidedly in the normal/high interest rate period.

Our Findings

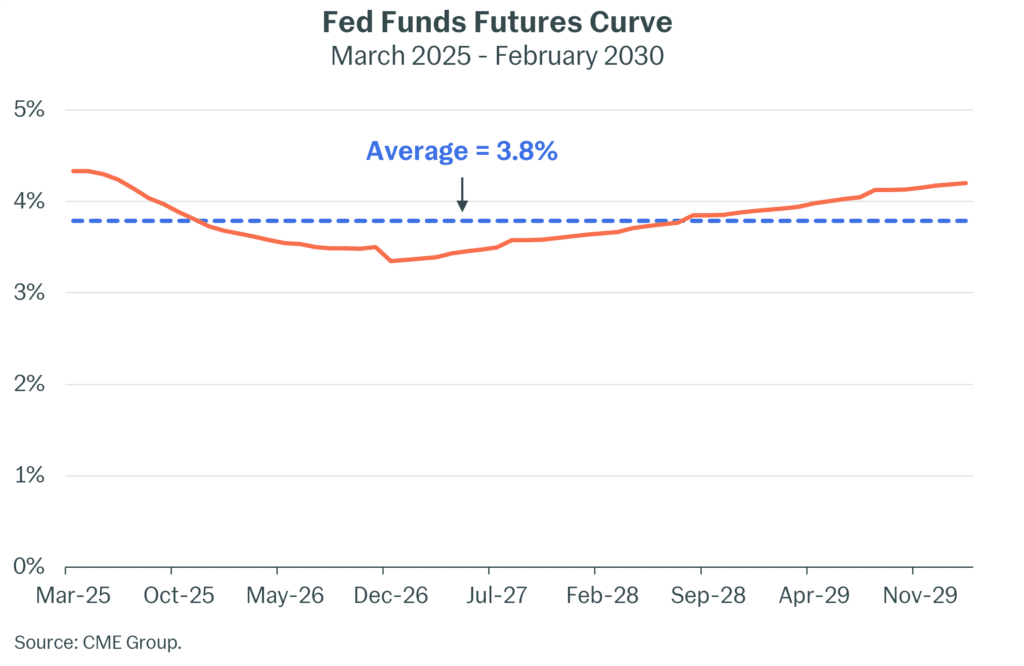

We found that U.S. interest rates have a strong association with active manager performance; and fortunately, we have a greater line of sight into interest rates vs. other types of datasets. A key forward-looking indicator is the futures market for the Fed funds rate, which is used by investors to hedge short-term interest rate risk.

In effect, Fed fund futures reflect marketplace expectations for U.S. monetary policy. Those expectations charted result in the Fed funds curve (shown below), which can aid in assessing the rate environment for the next five years, barring any major and unexpected event(s). Currently, the Fed funds rate is around 4.5% but as you can see, it is not expected to drop much below 4% going forward.

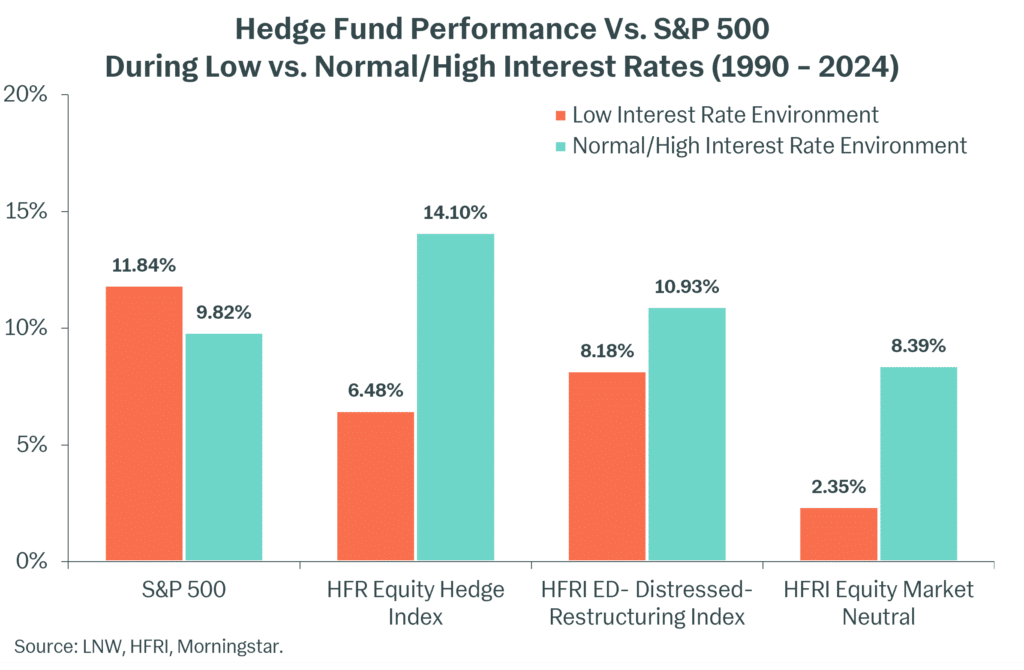

Drilling down into the various types of actively managed asset classes, we found that hedge funds (which we categorize as portfolio “Diversifers”) stood out. Hedge funds have had significantly higher absolute returns, as well as better relative returns, during periods of normal to high interest rates vs. periods of low rates.

Take a look at the chart above. For the analysis of hedge funds, we used a select number of HFRI indices. These are equal weighted indices made up of actual hedge funds that reported their net of fees returns and have been in operation at any point since January 1990.

As you can see, periods of lower interest rates (the orange bars) really weighed on the relative and absolute performance of various hedge fund strategies. But the opposite was true when interest rates were in the normal/high interest range (blue bars).

During normal and high-interest rate periods, equity long/short hedge funds experienced margins of outperformance that were quite substantial. So far in the 2020s, we’ve seen an increase in return for these strategies that is nearly double the rate experienced over the prior decade. The chart below shows the returns of various hedge fund indices relative to an index of global equities and bonds (the 50-50 ACWI IMI-Agg, which is depicted as the baseline 0.0). As you can see, the performance of hedge fund strategies began to improve as interest rates increased starting in 2022.

The Rationale

These results are not totally surprising because the opportunities for active managers increase during periods of normal/high interest rates for these reasons:

- Higher interest rates can lead to greater differentiation at the company level, creating better security selection opportunities. During periods of low rates, unprofitable or poorly managed companies can obtain financing, and the debt loads are manageable given the low cost of interest. But as rates rise, these companies struggle more than ones that can earn above their cost of capital or than those that don’t rely on capital markets to fund their operations. For some perspective, more than 40% of the companies currently in the small cap stock index, the Russell 2000, have no or negative earnings.

- Improved opportunities for security selection. During periods of low interest rates stocks tend to move in the same direction (high correlation) and move by similar amounts (low dispersion) which makes security selection less effective. However, equity markets during normal/high interest rate periods tend to be characterized by low correlations and higher levels of dispersion which is beneficial for security selection and therefore active management.

- The “short rebate” is once again meaningful. This is the interest that hedge funds earn on cash when they engage in short selling. When interest rates were low, the short rebate was near zero and in some cases detracted from a fund’s overall return. Now, market neutral funds or strategies that have significant amounts of short exposure can expect a meaningful contribution to return via the short rebate, say 3%-5% per year. For an equity market neutral strategy that may target an annual return of 12%, the short rebate currently can get them approximately a third of the way to that target.

What About Long-Only Equity Strategies?

We found that the impact of normal/high interest rates on actively managed long-only equity funds was not as consistent as seen for the hedge fund strategies. Index relative performance did see an improvement versus low interest rate periods, though there was notable variation based on manager style and market cap.

U.S. small cap strategies have shown higher potential for index relative outperformance than their large cap counterparts. This further reinforces our view that the U.S. large cap market is highly efficient and favors a passive investment approach. While active management in U.S. small caps continues to have the potential to add value to portfolios over time.

Our Conclusions

Having performed below expectations for roughly a decade, the opportunity set for hedge funds appears vastly improved given higher for longer interest rates. Expected returns for these strategies are now on par with historical assumptions and represent an attractive opportunity given their low correlations to traditional asset classes and potential to provide protection in declining markets.

Portfolios with existing allocations to Diversifiers such as hedge funds should ensure they are at target. Portfolios without exposure to Diversifiers, but with the ability to meet the investment requirements as well as accept the reduced liquidity, should strongly consider including them.