This may come as a surprise: There are hundreds of thousands of financial advisors in the United States. But only a relatively small percentage are bound by law to give you advice that is in your best interest. They are known as registered investment advisors (RIAs) and trustees, and they adhere to the fiduciary standard (see box at right).

What about all the rest? Most companies and individuals that call themselves financial advisors — including the major Wall Street firms — are actually commission-based salespeople. Their pay is determined mainly by the quantity and type of financial products they sell. Their legal obligation to you: investments that are suitable (known as the Suitability Rule). Beware, however: what is “suitable” can be against your best interest.

That is because when it comes to investment advice, broker/dealers may be biased by incentives. For example, mutual funds sometimes charge sales fees, which go to the broker if she/he gets you to invest in that fund.

EXAMPLE: A broker recommends an international equity fund with a maximum sales charge of 5.38% — in addition to the 0.71%1 annual management fee. Both costs will be paid by clients, putting them at a disadvantage compared to a similar-performing, lower-cost fund. Still, that pricey fund can qualify as suitable for clients, even though it may not be in their best interest.

Fiduciary Standard = Doing What Is Best for You

The notion of fiduciary duty — doing what is best for the client — dates back nearly a thousand years to English Law; it was first applied to property ownership and trusts.

In the U.S. today, trustees and registered investment advisors (RIAs) are bound to the fiduciary standard. All other financial advisors are NOT required by law to do what is in the client’s best interest.

Things to Ask and Consider

Registered investment advisors (RIAs) do not work on commission or other sales incentives. They are paid solely by you, and they are legally obligated to give you advice that is actually in your best interest.

Because many of the fees charged by broker/dealers and other non-RIA advisors are not fully disclosed to clients, it may seem that you are being charged less. However, look deeper and compare.

Very Much Worth Asking

- What is the total amount I am paying in fees, including sales fees and other incentives?

- Will I be given unbiased, strategic planning for my entire financial life?

- Will all the advice and guidance I receive be required by law to be in my best interest?

What if you do not need unbiased investment advice or wealth planning? In that case, a broker/dealer can be a cost-effective way to buy and hold individual stocks, bonds and low-fee mutual funds.

Know the Difference

To this day, many non-fiduciary financial advisors continue to fight against federal regulations that would require them to act in the best interest of their clients. The result: you are left to educate yourself.

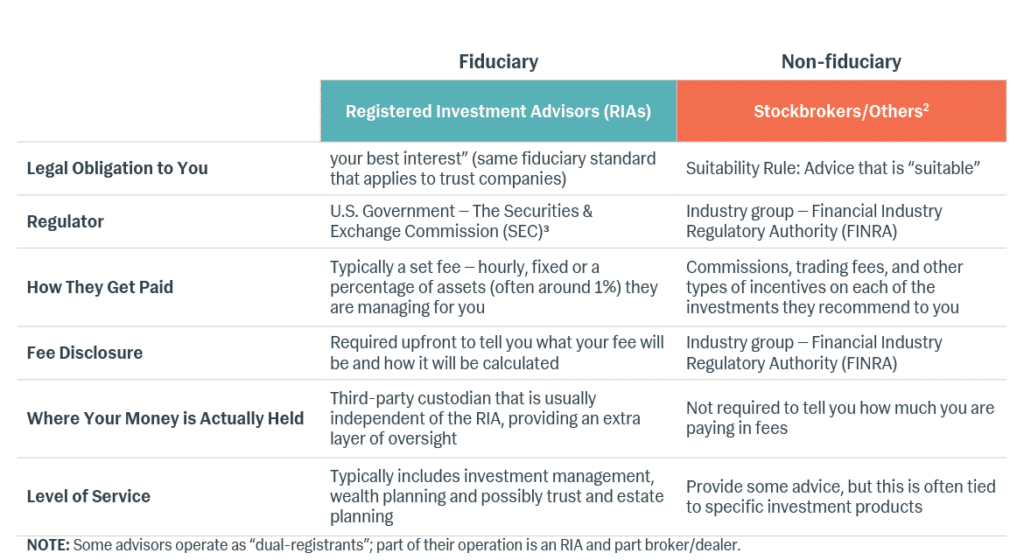

The chart below summarizes the main differences between two major types of financial advisors.

“Best Interest” Fully Defined

LNW comprises two trust companies and a registered investment advisor (RIA). In all the work we do for clients, we are legally required to act in our clients’ best interests. We recommend investments only if we are convinced such investments will work best for you, in terms of costs, taxes, return and risk. Our definition of acting in the client’s best interest also includes:

- Managing risk not only in your investment portfolio but across your entire asset base;

- Budgeting and income sustainability analysis so you know what your investment portfolio can support;

- Minimizing investment-related income taxes;

- Making sure your investments are aligned with your wealth and estate plans; and

- Making ongoing adjustments as your finances and life change.