On May 20, 2025, Washington State enacted significant tax law changes for individuals and businesses aimed at reducing the state budget deficit. For individuals, the changes target the sale and transfer of high-value assets.

Washington State Capital Gains Tax: Retroactive to Jan. 1, 2025

- The long-term capital gains tax rate has been raised to 9.9% (+2.9%) on amounts exceeding $1.27 million.

- Gains up to $270,000 (2024 tax year) are covered by the standard deduction. While that amount is adjusted for inflation annually, the standard deduction amount is the same for singles and couples filing jointly.

- The first $1 million in gains over $270,000 will continue to be taxed at 7%.

Who Is Subject: Individuals whose primary residence is in Washington State AND anyone who has gained from the sale of a capital asset held for more than a year, including tangible personal property (art, cars, boats, planes, etc.), within or allocable to WA State. There is a limited charitable deduction for donations to WA State charities.

Some Key Exceptions: Real estate transactions – including distributions from privately held entities if the gain is from directly owned real estate; Investments within retirement accounts (IRAs, Roth IRAs, 401ks, etc.); Business transactions that do not generate capital gains or are taxable as income, including tax-free mergers, transfers to partnerships, and gains from sales of qualified small business stock; Qualified family-owned small businesses with less than $10 million in annual revenue.

Trusts: Trusts based in WA State are not subject to the tax; however, trust beneficiaries who receive allocations of gains may be subject to the tax. A similar rule applies to partnerships, LLCs and other pass-through entities: the beneficial owners pay the applicable WA capital gains tax on their share of gains.

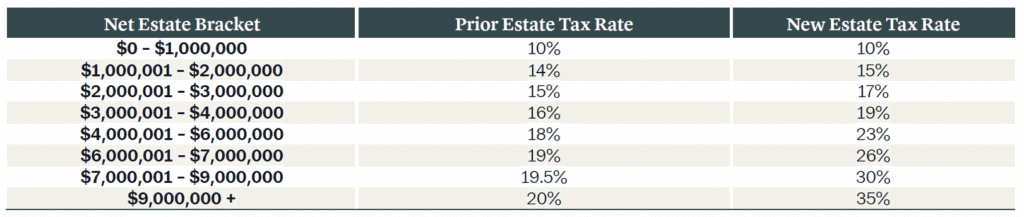

Washington State Estate Tax: Effective July 1, 2025

- The WA estate tax exemption increases to $3 million per person (from $2.193 million), adjusted annually for inflation beginning in 2026.

- WA estate tax rates rise on all but the bottom bracket, with the biggest increases at the top brackets.

- For taxable estates of $9 million or more above the $3 million exemption, the rate jumps by 15% (increasing from 20% to 35%).

Things to Consider

WA Capital Gains Tax: Because there are many exemptions for WA State capital gains taxes, consulting with your advisors to conduct advanced planning can result in tax deferral or mitigation.

WA Estate Taxes: The higher exemption in effect starting July 1, 2025 means that estate taxes apply at a higher level (to estates exceeding $3 million per individual for the remainder of 2025, indexed for inflation beginning in 2026).

Lifetime gifting to family and nonprofits, as well as using irrevocable trusts to remove assets from an individual’s balance sheet can reduce exposure to WA estate taxes. For those who already have an irrevocable trust(s) in place, we recommend reviewing the terms to see if moving the trust to another state (change in situs) is allowed. If not, perhaps the terms can be modified to allow for that.

If you are considering establishing a new irrevocable trust, in addition to including provisions that allow for flexibility regarding the trust’s situs, you may also want it to proactively locate it in a state such as South Dakota, which does not have an income tax and whose laws enhance trust privacy and longevity.

It’s worth noting that WA estates large enough to also be taxed at the federal level ($13.99 million or more per individual) may deduct WA estate tax paid from the federal estate tax liability.

Alternatively, some people may simply accept paying WA capital taxes or more WA estate tax because the revenues are earmarked to support education: the proceeds are distributed to the education legacy trust account (and, in the case of WA capital gains tax revenues, also to the common school construction account) to fund school operations (and construction) within the state.

If you are an LNW client, please reach out to your LNW advisory team to discuss how your current wealth plan could be impacted by the new WA State taxes and for proactive strategies tailored to your specific situation.