Wealth

Management

Comprehensive wealth planning

to achieve your aspirations

Outcome-based wealth planning

Your vision for your assets brought to life

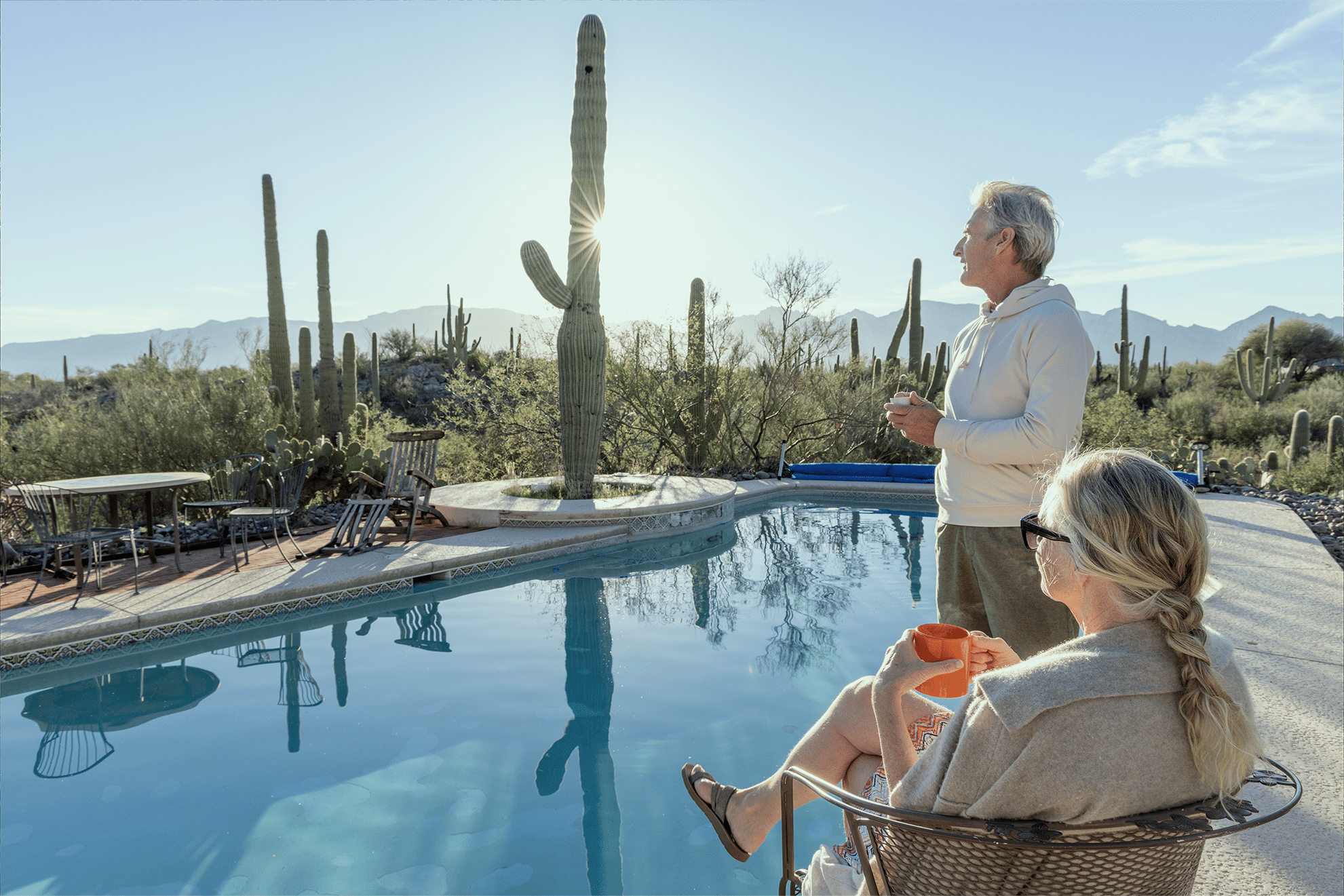

Your financial life has a large number of inter-related facets. Your LNW team can synthesize it into a single unified view. In the process, we help you clarify the precise outcomes you want to create. We encourage you to dream big, optimizing your assets in support of your vision for your life.

Your custom wealth management plan incorporates your career or business plans and trajectory, your goals for your family, including education, your retirement, your legacy, philanthropy, your values, and much more.

Everything in your plan is calculated with your ultimate objectives in mind, as well as the all-important tax considerations. Your plan is dynamic. As your circumstances evolve, your plan evolves, too.

Learn more about these dimensions of LNW wealth management:

- Equity compensation

- Tax strategies

- Education planning

- Retirement planning

- Philanthropic planning

- Business owner concerns

- Insurance analysis (including life, homeowners and unique needs)

Sign up for

Navigator

Receive timely, relevant insights on investments, wealth planning, taxes and trusts from the specialists at LNW. Navigator will appear in your inbox quarterly.

"*" indicates required fields

Wealth Planning Q&A

The Q&A below provides a general idea of how we can help. We take a holistic approach to understanding you and your wealth, allowing you to see all that is possible.

What questions do you have?

We have been doing just that since 1967: helping families preserve, grow and transfer their wealth methodically, tax-efficiently and in line with their values and goals. At LNW, you will find deep experience with the human side of wealth planning – including family dynamics and enabling the younger generations – as well as all the strategies and tools required to establish and then support your legacy over many decades and even a century or more.

Congratulations! To start, we can provide you with detailed, realistic estimates and what-if scenarios so you can see your big picture over many decades and make the best possible decisions for you and yours. This can include which state you choose as your primary residence, strategies for re-investing the proceeds, the establishment of one or more trusts, an estate plan and exploration of your next big thing.

Definitely. LNW can serve as your wealth advisor throughout the divorce negotiations/proceedings, prioritizing your financial, physical and mental health. After gaining a full understanding of your situation and goals, we will assess what would work best for you financially, advise your attorney(s) accordingly, and then put in place an optimal investment and wealth plan for your new life, as well as helping to create or update your estate plan.

We can help you make the most of these assets to support the life you want. Since the early 1990s, LNW has advised on equity compensation in its many forms, including various types of options, RSAs and RSUs. Our work centers on your finances and personal goals and includes selling and tax strategies, ownership vehicles, and contingency planning via insurance. We leave no loose ends untied.