What’s the Difference?

Active investing – Investing in whatever securities seem most attractive based on risk and return criteria and selling them when they appear overvalued.

Passive or Index investing – Buying and holding a pre-determined basket of securities based on a specific index (i.e.S&P 500, NASDAQ, MSCI Emerging Markets).

PART I: The Active/Passive Investment Debate

One of the more contentious issues in the investment world is the debate about active versus passive management. In other words, index funds vs. actively managed funds (see box at left). Many investors believe you must be in one camp or the other and that ultimately, the decision for a portfolio is “binary” − all active or all passive.

At LNW, we believe that active AND passive strategies are best combined in order to manage risk, lower fees, and take advantage of compelling investment opportunities. Additionally, we believe the use of both active and passive strategies allows us to create portfolios that more closely match client goals, constraints and risk preferences.

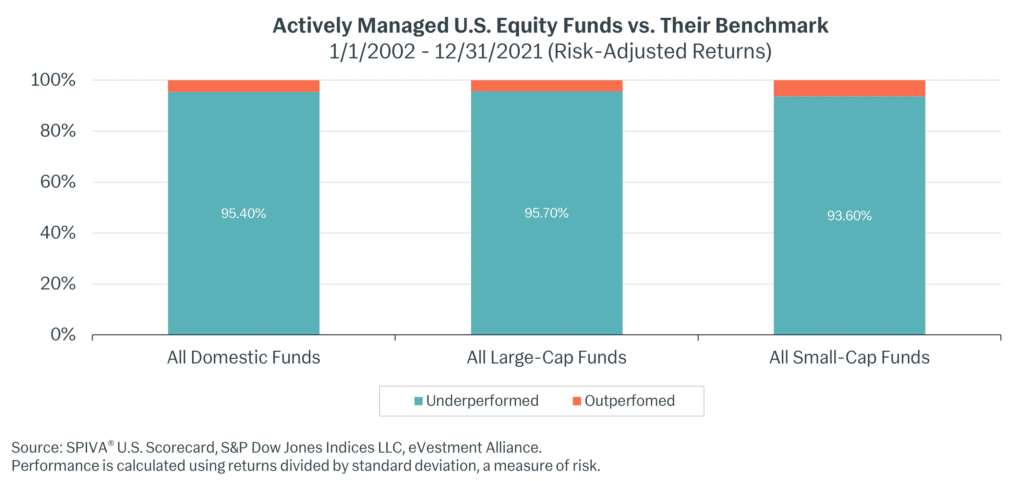

As many academic studies have shown, the average actively managed mutual fund usually underperforms its benchmark index after fees, particularly in certain types of asset categories, such as U.S. large cap equities. LNW does not contest this; however, we think it is important to put these results in context. We contend that there is a group of fund managers, albeit small, who have demonstrated the ability to consistently outperform their respective benchmarks, after fees, over a full market cycle. We classify these managers as “above average,” and those who outperform consistently and in a significant way “best-in-breed.”

In this three-part article, we examine (1) the pros and cons of passive and active investing as they apply to publicly traded global equities; (2) why we use both approaches; and (3) how we find managers likely to outperform over a full a full market cycle.

Index Funds and Other Passively Managed Vehicles

At LNW, we see the following attributes of index funds and other passive vehicle as valuable:

Pros

- Easy to buy and sell quickly.

- Can invest in entire market (global stocks) as well as sectors (biotech, technology, etc)

- Return and risk stay in the same range as the targeted benchmark index.

- Lower management fees than actively managed funds, in most cases.

- More tax-efficient (vs. the average actively managed fund) since they do not trade often.

Cons

However, there are problems with using only index funds and other passive strategies, including:

- Virtually guaranteed to underperform the target index. Due to fees, returns on passively managed funds consistently lag their market benchmark. Fees typically range from 5 to 70 basis points, depending on the fund.

- Require active asset allocation decisions. You must still choose which index funds to invest in – asset allocation – and all these decisions are usually the greatest determinant of portfolio returns over time. If more than 52% of an equity portfolio is in U.S. stock funds, for example, an active decision has been made to overweight the U.S. relative to foreign markets.

- Provide an easy out for many financial advisors. By using mostly index funds in client portfolios, advisors can claim market-like returns for each of their allocation decisions, at a relatively low cost. At the same time, they avoid the expense and resources required to research, invest in and monitor actively managed funds. Done right, this level of research requires hundreds of meetings a year and significant investment in data systems and procedures to help evaluate managers. At LNW, we believe these additional costs are essential to offering best-in-class wealth management.

Actively Managed Funds

There are also benefits to investing in actively managed funds, which differ greatly in performance, fees and capabilities. The key is finding those managers who can outperform their benchmark over time.

Pros

- Actively managed funds have the potential to significantly outperform the market in terms of risk-adjusted return over a full market cycle.

- Depending on their investment guidelines, managers can try to actively protect against market downturns.

- Depending on their investment process, managers can implement strategies not available through index funds (short-selling, holding cash, leverage, etc.).

- Can use strategies that minimize taxes by offsetting gains with losses.

Cons

- Outperformance by active managers has shown little consistency year over year.1

- Most actively managed funds are “closet indexers” in that they mimic a specific benchmark while charging higher fees.

- Relatively tax-inefficient compared to passive funds.

- Tend to charge higher fees than index-based funds, which detracts from returns.

- Researching and accessing market- beating active managers requiresgreat effort and ongoing due diligence.

Why Some Actively Managed Funds Outperform

Academic studies have shown that most actively managed funds do lag their respective benchmarks in any one year and also over longer periods. However, academic and industry research further presents that active managers with the following three characteristics have a higher likelihood of outperforming their benchmarks:

- Long-term Perspective/Low to Moderate Turnover: If you strip out actively managed funds that closely mimic their benchmark, aka “closet indexers,” truly active managers with a long-term investment horizon have delivered returns better than their benchmark2. These managers benefit from buying stocks whose valuations can compound and/or revert to their historical average over time. The investor benefits from receiving mostly long-term capital gains, which are taxed at lower rates, as well as lower trading costs.

- High Conviction: This can be measured by the level of concentration in the portfolio (for instance, certain sectors are significantly more or less represented than in the target index), as well as a relatively low correlation (known as R2) with the returns of the benchmark index3,4,5. This is intuitive, in that managers essentially must invest differently than the index to outperform the index, and those that significantly outperform will likely be highly differentiated.

- Low Fees and Expenses: The lower the fee/expense of the fund, the more likely it is to beat the benchmark all else being equal. This is why LNW actively uses its size and industry standing to bargain for fee reductions that we then pass on to clients. In markets that are more difficult to research and therefore less price-efficient, such as foreign equities and U.S. small stocks, the difference in fees between active and passive funds is not very wide, providing the best environment for active managers.

PART II: Passive or Active Managers? Equity Market Efficiency Is Key

We think the key question that underlies the active/passive debate is this: how efficient are equity markets? Conventional wisdom holds that the world’s most efficient equity market is large capitalization stocks in the U.S., such as those in the S&P 500, given that thousands of analysts and millions of investors worldwide are constantly scouring for inefficiencies. The least efficient markets? Those with less analyst coverage and those that are less popular with investors (i.e., small stocks, emerging markets, etc.).

Is conventional wisdom correct? It may be at certain times, but not always. If U.S. large-cap stock prices fully reflect the prospects of each company at all times, why would skilled investors such as Warren Buffett continue to make large investments in certain “undervalued” large U.S. stocks?

Evidently, not all publicly available information is incorporated into the stock price.

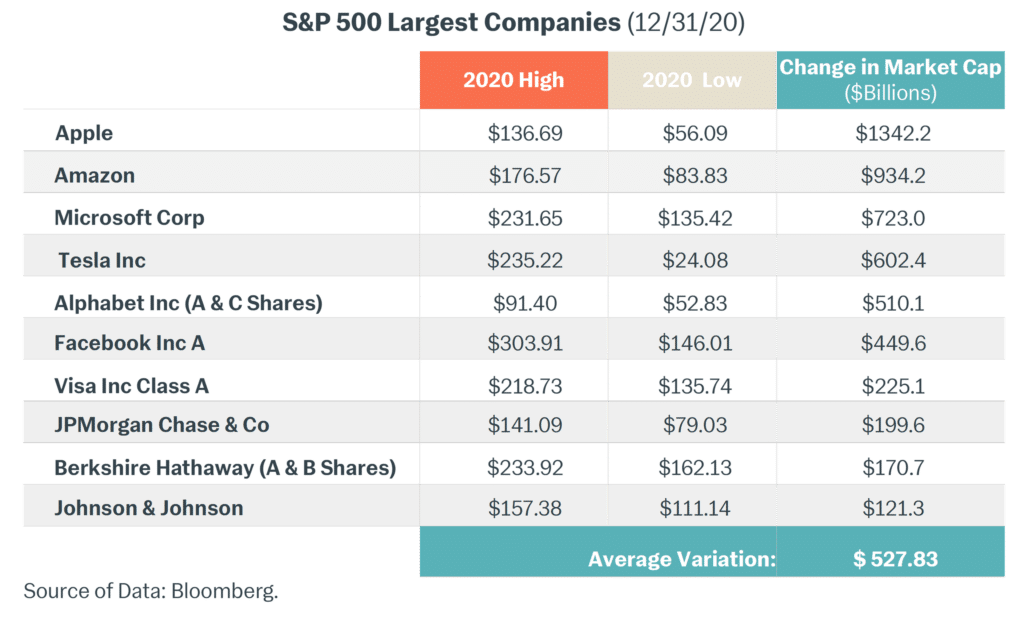

That was especially true in 2020, when uncertainty due to the COVID-19 pandemic caused the valuations of even the world’s largest, most established companies to fluctuate wildly. The level of market inefficiency can be gleaned in the above table, which we have recreated based on prior work by Hotchkis & Wiley. The table lists the 10 largest S&P 500 companies by market capitalization as of Dec. 31, 2020. It displays both the high and low share prices for 2020 and the change in total market valuation between the high and low. For example, Apple traded between a low of $56.09 and a high of $136.69 in 2020. As such, the change in Apple’s market value from low to high was $1.34 trillion. Consider that the amount of change in Apple’s valuation over the course of 2020 was more than the combined valuations of Ford, General Motors, Target, Macy’s, Caterpillar, Kellogg, and Delta Airlines at the end of 2020!

Was there $1.34 trillion worth of new information about Apple during 2020? We are skeptical. Given the above example and the fact that investors have behavioral biases that lead them to make less than perfectly rational decisions over time, the prudent investor should be skeptical that stock prices always reflect all available information. Best-in-class managers should be able to capitalize on inefficiencies in pricing as they appear.

PART III: Finding the Right Managers

In LNW client portfolios, we use both index funds and actively managed funds to work toward our goal: attaining the risk-adjusted return over a full market cycle that will allow each client to meet their goals.

Finding and staying invested with best-in-breed managers who are not “closet indexers” (those who mimic an index) is challenging. In an expose titled “The Morningstar Mirage,” The Wall Street Journal noted: “Of funds awarded a coveted five-star overall rating, only 12% did well enough over the next five years to earn a top rating for that period; 10% performed so poorly they were branded with a rock-bottom one-star rating.” This demonstrates the pitfalls of relying too much on past performance and/or second-hand research. Doing so is a losers’ game, as investors pile into a manager whose portfolio has benefited from certain characteristics (investment style, size of stocks, etc.) and/or pure luck at the top of the investment cycle, without regard for how the portfolio is positioned currently.

LNW relies on our proprietary, in-depth due diligence process for manager selection. We have devoted significant resources to conducting comprehensive and in-depth first-hand research on managers in order to identify those that are best-in-breed.

In practice, this means the LNW investment team conducts hundreds of meetings every year with managers in all major assets classes to find those that are truly exceptional. These meetings are held in-person, by phone and/or video conference and usually entail multiple meetings with managers of interest to us or already in our portfolios.

This process is both qualitative and quantitative. Qualitative in that we meet and evaluate the majority, if not all, of the investment staff of compelling managers. These meetings allow us to evaluate managers on numerous categories including organizational environment, investment staff, security selection, research, implementation, sell discipline, asset allocation and securities selection. From a quantitative perspective we evaluate:

- Long-term performance patterns and periods when the manager has underperformed/ outperformed.

- Value added by the portfolio management team over time (buys/sales/trims/adds).

- Portfolio risk and key metrics to determine if potential returns justify the level of risk.

- How the manager pairs with other managers in our portfolios and what the performance of the managers in tandem is expected to look like.

Ultimately, we believe consistent and in-depth due diligence will guide us to those managers whose performance will be above average over time and provide our clients with strong risk-adjusted returns relative to their peers and to the markets.

Staying Invested

Long-term outperformance is not based on a calendar year. Selling out of a fund after a year or two of underperformance is fairly common, but it can also be a mistake. To make the right decision, you have to understand WHY the fund is underperforming. Potential drivers of underperformance include:

- Investment Style: A fund whose manager invests in foreign developed markets may have a bias toward value stocks (vs. growth) and because of this may lag the MSCI EAFE Index in years when growth investing is in favor.

- Portfolio Characteristics: A fund focused on emerging market equities may invest mostly in smaller stocks. Not owning the 10 largest stocks in the emerging markets index (the MSCI EM) could be a drag on performance during a strong market rally.

The two above biases – a focus on value and smaller capitalization – should be expected to lead to underperformance occasionally. In fact, they are a key reason for investing in these funds: to get the exposure to value stocks and to smaller stocks.

However, underperformance is a concern if the fund managers are deviating from their usual focus and approach, are distracted by organizational issues (i.e., too many funds to manage effectively, employee turnover, etc.), or are not actively positioning the portfolio based on risk and return criteria and/ or lowering their research standards. All these issues, especially the latter, would likely necessitate a thorough review of the fund and possibly termination of its use.

LNW’s Whole Portfolio Approach

At LNW, we use a combination of passive and active investing within a portfolio, depending on the market outlook and characteristics. Typically, we use index funds for exposure to large U.S. stocks, given that this is a more price-efficient market than other assets classes (foreign stocks, etc.). That said, there are times when actively managed funds can make sense here. During times of higher market volatility and/or falling prices, a top active manager in U.S. large-cap equities is more likely to outperform the S&P 500.

By contrast, we typically use actively managed funds to invest in U.S. small stocks as well as foreign equities, especially in the emerging markets. These markets are much less efficient when it comes to pricing and usually entail more risk. Astute managers can take advantage of pricing discrepancies so that returns compensate for the higher fees they charge (relative to an index) as well as the potentially higher taxes on trading gains. If an actively managed fund is not likely to outperform its benchmark index over a full market cycle, after fees and taxes, we do not invest.

Finally, our alternative asset allocations within portfolios – mostly hedge funds and private equity – are by definition all actively managed funds. Our aim in using alternative asset funds is to lower risk without greatly sacrificing return. To do that, we want our alternative asset managers to invest in a way that veers from the market averages as much as possible. So when markets fall, our alternative assets have a chance to rise and offset some of the losses in traditional assets (stocks, bonds, real estate).

Minimizing Fees & Taxes

- FEES. LNW pays close attention to fund management fees. Our size allows us to negotiate fees on our clients’ behalf when it comes to investing via mutual funds as well as separate accounts. We focus on managers most likely to deliver superior performance at reasonable fees in their specific asset class.

- TAXES. Because taxes detract from net long-term returns, we analyze likely tax bills (for taxable accounts) when developing an investment plan and selecting appropriate managers. This said, actual differences in long-term performance will be based on the style of the manager and turnover of the portfolio. Managers who buy and hold stocks for more than one year benefit from fewer short-term capital gains. Also, some managers actively attempt to minimize taxes through “tax-loss harvesting” – using losses to offset gains. As part of our due diligence, LNWM reviews manager tax awareness as well as investment style and turnover.