When your kids (or grandkids) get their first credit card, that’s a great time to talk to them about credit scores. Nearly 60% of Americans over 18 have no idea what their credit score is, and for those in their 20s, this figure is even higher. That’s too bad, because as many of us know a credit score follows you around for life. And those in their late teens and early 20s are in the best position to establish good credit and reap the benefits for many years to come.

Drawing on the things we teach at our NextGen Money workshops, here are the main things to tell young people as they start using their newly minted credit cards:

A credit score is way more than your payment history. It’s actually a math formula based on:

- Payment History (35%): The best way to boost your credit score is to pay all your monthly credit card bills and loan payments (car loans, student loans, mortgage) on time and in full. If you can’t pay your credit card off in full, be sure to at least make the minimum payment, although that can really set you back over time.

- Utilization (30%): Try not to use more than 30% of your total credit limit. For instance, if you have a $300 limit on one card and a $700 limit on another (total $1,000), do your best to keep your monthly balances below $300 total.

- Length of Credit History (15%): This is why it’s important to start young. Your credit score takes into consideration how long you’ve had a credit score. So, you can’t just pay your bills on time for a year and expect to have an excellent credit score. Building great credit takes time.

NOTE: Be very wary of in-store credit card offers, such as getting a Gap card so you can get 15% off on your purchase. Opening and closing a credit card account within a few months hurts your credit rating, no matter how long you’ve used credit cards responsibly. - Types of Credit (10%): Realize that credit cards are just one type of credit. The credit reporting agencies like to see that you can responsibly handle multiple sources of credit, such as a credit card plus perhaps an auto loan, student loan, mortgage, or business loan. These are some of the most common types of credit, but by no means the only types.

- New Credit (10%): The smallest component of your credit score is new credit. This one is a bit of a double-edged sword. Credit reporting agencies don’t like to see too many applications for new credit, since this increases the risk you won’t pay. However, over time you need to show you can handle new types of credit to improve your score. But there is no rush here. Get used to managing one credit card really well. Then apply for an additional card if you have a good reason.

Think you can ignore your credit score? Think again. Credit scores affect:

- The interest rate you get on loans: The higher your score, the less you will be charged in interest. On any kind of loan. The difference between 4% and 6% in interest can add up to thousands of dollars a year.

- Getting a job: Believe it or not, your credit score can influence your ability to get a job. There is some legislation in different areas of the country that opposes this, but at this point, it is not unusual for a potential employer to run a credit check on candidates.

- Buying a house, a car, or qualifying for any loan: Unless you’re prepared to pay cash for your house or your car, you will probably be applying for a loan. You already know that your credit score will impact your interest rate on these loans, but in some cases, your credit score (or lack thereof) could disqualify you completely from being able to borrow money.

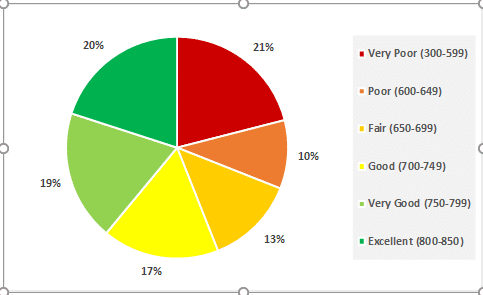

How Credit Is Scored

Like grades at school, credit scores fall all into six categories

You should check your credit score each year. Equifax, Transunion, and Experian are the three credit reporting agencies that provide credit scores. While they can each give you a different score, the difference is usually minor. By law, you are entitled check your score at these three agencies for free each year. You can also use websites like Credit Karma and freecreditscore.com to check your score. Check to see that there are no mistakes or fraudulent activity on your record.

But don’t check your score more than once a year, unless you must. The more credit check requests the agencies get on you, the more suspicious they become about your finances. Too many checks raise orange flags and could hurt your credit score.