More so than the US-China trade war, coronavirus has brought to the fore China’s big role in global trade and the operations of certain US multinationals. Between 2003 (when SARS hit) and 2018, China’s portion of world trade doubled — from 5% to 11%. China now accounts for 16% of global GDP (2019 estimate) vs. 24.5% for the US and is 34% of the MSCI Emerging Markets Index. So yes, when China sneezes, literally and figuratively, it is a much bigger deal than it was a decade ago.

However, the direct US impact is much higher in certain sectors than in others. Of the S&P 500 companies, exposure to China is highest in three sectors — Information Technology, Materials, and Industrials. Most US industries — from healthcare, to financials, to utilities and real estate — have very limited or zero exposure to China. On average, China accounts for roughly 7% of the revenue of S&P 500 companies (based on FY 2017 data from Goldman Sachs), although this does not take into account how much of their production is based in China, nor the heavy impact certain consumer sectors, such as travel, could experience.

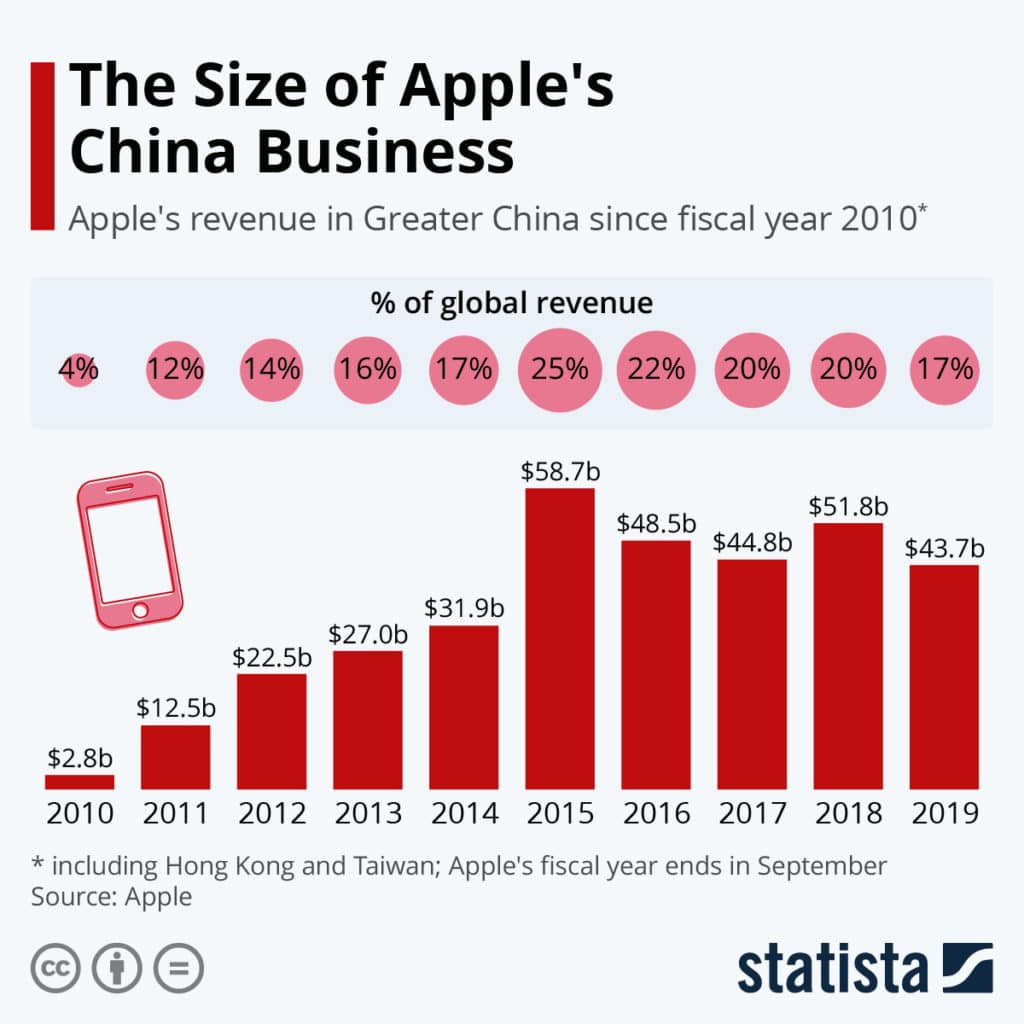

Apple, for instance, gets 15% of revenue from sales to Chinese consumers, and most of its products, including the highly profitable iPhone, are made in China. Given that many retail stores in China remain closed and manufacturing facilities are operating at reduced levels, it is not surprising that Apple recently said it will not meet its previous earnings forecast for the 1st quarter of 2020.

The expectation of analysts and institutional investors so far has been that US corporate earnings will be negatively impacted by the coronavirus in the near term, as China’s economic growth drops dramatically in the 1st quarter of 2020 (from around 6% to perhaps 3.5%). But by around mid-year things are generally expected to get back to normal. Consider that analyst forecasts for S&P 500 profits show an average expected increase of around 7% for 2020, not a big drop from the 9.4% expected at the beginning of this year.

In our Q1 2020 Economic Outlook, we indicated that corporate earnings would be one of the main drivers of US stocks in the coming year, since a great deal depended on an earnings rebound in 2020 (after very low growth in 2019). We are monitoring the impact of the coronavirus carefully, since there are lots of ways this can play out. The spread of the disease could stop accelerating but it could continue to impact trade and operations for longer than expected.