The US stock market opened on a high note in 2020, the Year of the Rat. But whether that good fortune continues throughout this year, we think will depend on two key things: (1) A rebound in corporate earnings; and (2) low interest rates.

Corporate Earnings: Bound for a Rebound?

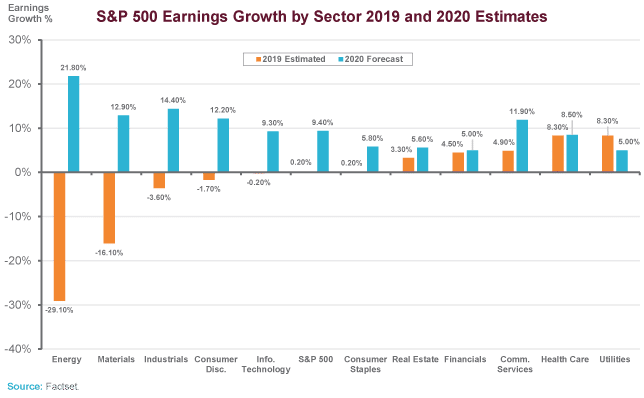

In our Q1 2020 Economic Outlook, we pointed out that 2019 earnings for the S&P 500 companies are expected to be essentially flat — zero growth over all (see orange bars in chart below). Yes, even the tech sector (Information Technology) had flat profits in 2019, despite a handful of highflyers like Apple and Amazon. Yet the S&P 500 stocks gained about 30% on average in 2019, including dividends. What is interesting is that analyst estimates are for S&P 500 earnings to rise about 9%, on average, in 2020, with the biggest rebounds in Energy, Materials, Industrials and Consumer Discretionary, sectors that were hard hit by the global slowdown caused by new tariffs, especially between US and China. Now that the US and China have signed Phase 1 of a trade deal, the expectation is that trade and earnings will pick up.

Keep in mind that corporate earnings in 2018 got a huge boost from the 2017 tax cuts. So 2019 was a tough year for comparisons, in addition to the strife caused by trade tensions. But 2020 should start to show growth. If this is in fact what happens, then perhaps stocks have more room to move up. Another flat year of earnings, though, will be worrisome for US equities.

Interest Rates: Flat Is Where It’s At

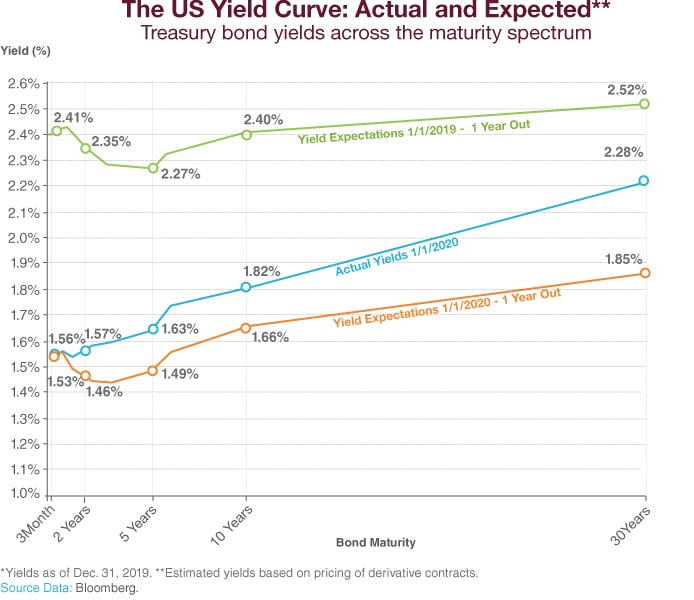

The other key thing is US interest rates. As we started 2019, the expectation was that rates would move higher (see top line on chart below). But the exact opposite happened. The Federal Reserve cut its key interest rate three times in 2019, and higher-risk assets such as equities began to look really good again. Now expectations are that interest rates will remain low for a long while (see bottom line of chart below). The elixir that keeps driving the market moving higher — low interest rates — is not about to run dry. But it may not be as strong as it was last year, since essentially no Fed rate cuts are expected in 2020. US economic growth will have to happen without the aid of lower corporate taxes and dramatically lower interest rates. In fact, a big drop in interest rates from current levels would not be a good thing, indicating a slowing economy.