As you have likely heard over the past year, the Tax Cuts and Jobs Act of 2017 (TCJA) is set to expire in January of 2026. With its expiration, important tax and estate planning provisions are scheduled to change. Most notably, the significantly elevated federal estate and gift tax exemption is poised to reduce by half. While the results of the recent election changed the outlook on what the future exemption is expected to be, that future is not yet guaranteed until a new law is signed. The time is still right to carefully consider whether there are changes you should be planning to make in the coming year to take advantage of the current, generous exemption level.

For some, there may be potentially significant benefits to taking advantage of the current exemption amount, but the situation is highly dependent on your personal circumstances. With any choices you make in your long-term planning, you want to be confident in the fundamental decision-making process that leads you to make that choice. There will inevitably be more legislative changes in the future. The most important factors into any decision should always be whatever best serves your highest goals for yourself and your loved ones.

What is the Estate and Gift Tax Exemption

The Federal Gift and Estate Tax Exemption is a provision of the federal tax code that allows for a specified amount, the basic exemption amount (BEA), to be gifted or bequeathed to an individual’s heirs during life or at death without being subject to federal gift and estate taxes. It’s important to note that this lifetime exemption is separate from the much smaller annual gift tax exclusion and transfer tax exclusion for direct payments of tuition and medical expenses. The annual gift tax exclusion is limited to $19,000 per person ($38,000 per couple) in 2025 (subject to inflation in subsequent years). This annual exclusion amount applies to transfers made in a particular year and resets each January 1st.

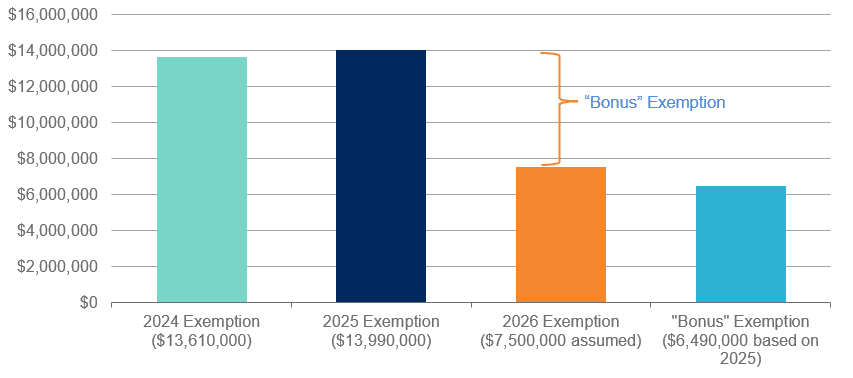

The basic exemption amount is adjusted for inflation annually and applies to each giftor individually. When the TCJA went into effect, the exemption amount doubled from $5.49M in 2017 to $11.18M in 2018 and has continued to increase with inflation in the years since the law’s passage. The TCJA is currently scheduled to sunset on January 1, 2026 and with it, revert the exemption amount to the pre-TCJA level, adjusted for inflation. This places it at an estimated $7.5M, or just more than half of the 2025 amount of $13.99M.

How Likely Is the Exemption Amount to Change

Because the TCJA was an important legislative piece of President Trump’s first term, it is reasonable to imagine that the law will be extended or updated with provisions similar to the original, including the heightened level of the transfer tax exemptions. However, it’s important to note that nothing has been determined yet and that politics is a difficult thing to predict. It’s possible that the TCJA in general or the exemption amount specifically might become a trade-off as part of a negotiation for other legislative priorities, it’s possible that the TCJA might be temporarily extended and then face scrutiny from a flipped Congress after the midterm elections in 2026, or any number of other scenarios. It is also worth noting that the TCJA was not passed until December of 2017, so it is possible that we will not have a concrete resolution until close to the currently scheduled sunset of the TCJA.

Given all of this uncertainty, the potential alone for the exemption amount to be drastically reduced should not be a singular driving factor in your planning choices. However, where it aligns with your other plans and priorities it is worth considering whether you can and should take advantage of what we know is a generous current exemption amount while it’s available.

Potential for “Bonus” Exemption

If the TCJA were to be allowed to expire, taking advantage of the 2025 amount could result in an additional more than $6M in exemption.

What to Consider

Before you decide whether to make large gifts in 2025 to take advantage of the current exemption amount, there are several factors to consider along with your advisory team, CPA and estate planning attorney.

Are you certain you want to gift more than $7.5M? Gifts are difficult, if not impossible, to undo. Before jumping on the opportunity to take advantage of the current exemption, carefully consider how much you really want and are able to gift. If you’re uncertain whether you’d like to give more than the $7.5M projected exemption amount if the TCJA were to sunset, then you are likely better off waiting until you are confident in the amount and nature of your gifts. The added benefit of patience is also that you can assess whether any new rules in the gifting arena are particularly additive for your family. The road is long and winding, so waiting for clarity can have unanticipated benefits.

Can you comfortably gift more than $7.5M now without negatively impacting your finances in the short term? Even if you are certain that in the future you would plan on gifting the full nearly $14M exemption amount (or $28M per couple), work with your advisor to think through your cash flow needs and financial plan to be certain that making a large gift now won’t be a detriment to your lifestyle and plans over the next few years.

Who to gift to and in what capacity? If you have multiple children and/or grandchildren you intend to benefit, consider to whom and how you would like to gift. For example, consider making gifts to trusts that benefit multiple generations, instead of a larger outright gift to the closest generation with the expectation that it would eventually pass to the younger generation(s). If you’re uncertain of which assets you want to gift or to whom, your better choice may likely be to wait until you can make those choices confidently.

Is a cash gift the right choice now? Gifting a large amount of cash or other liquid assets now may be the right choice, depending on the age of your heirs and other factors, but it is not uncommon to feel uncomfortable simply turning over that kind of significant amount at once. Funding a trust for the benefit of your heirs is a way to take advantage of the exemption now while creating some guardrails on what happens to the assets you’ve gifted.

Are there ways other than gifting to mitigate your future estate tax burden? Think through what you would hope your heirs would get out of any assets they may be gifted or eventually inherit and consider whether there are other options aside from direct gifting to accomplish that goal. Funding future education through a 529 plan or a pre-paid tuition plan available at some schools, or directly paying for tuition and medical expenses, for example, instead of giving cash or funding a trust for those purposes, could leave more of that exemption amount available.

When considering all of these elements, it’s also important to remember that the timing of gifting can be important outside of any considerations around the exemption amount change. The appreciation of assets over time has potential benefits to both you and your heirs. For example, gifting your child securities now that will appreciate may make more sense than gifting them the appreciated securities or the cash value in the future, depending on factors such as your income level and your expected capital gains. Whatever you choose, the decision-making should consider the full picture of you and your family’s wealth and goals.

Strategies for Married Couples

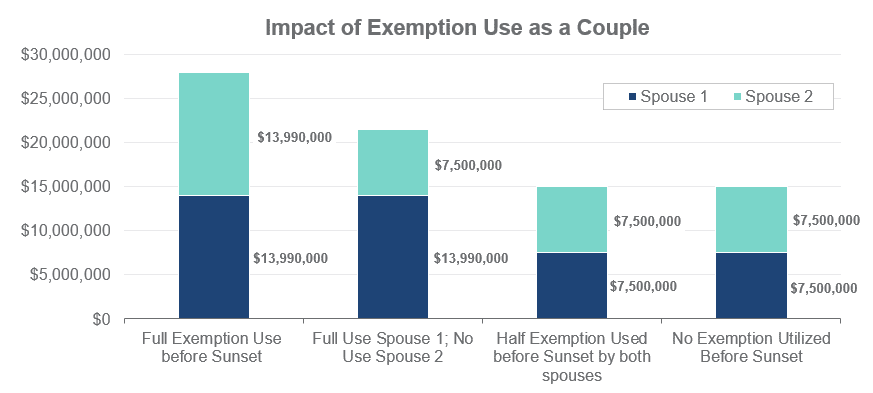

One important factor for married couples considering gifting to their children or grandchildren to remember is that the nearly $14M exemption amount is per person, not per married couple, even if you file taxes jointly. As a result, the individual who provides the gifts can have a significant impact on the eventual estate tax burden.

If you’re unsure whether both you and your spouse will use your full exemption amount, think carefully about the titling of assets before gifting. In the event that the exemption was to decrease before all your gifting is made, you are almost certainly better served by gifting the full $13.9M from one of you now and having at least the other spouse’s $7.5M available in future than, for example, gifting half that amount from each of you now and having little to no exemption left for either of you in future years.

For example, if a gift of the full current exemption amount of nearly $14M was made by one spouse in 2025, they will have used their entire individual exemption. Their spouse will have used none of their exemption. This would mean that in the event the exemption amount was to revert to pre-TCJA levels, the second spouse would still have their approximately $7.5M exemption available in future years. If that same $14M was given in 2025 as $7M by one spouse and $7M by the other and the exemption amount were to revert, the couple would only have approximately $1M remaining in their exemption. What you give and from whom can be as important as how much.

Consider Your Trust Options

If an immediate transfer of assets does not make sense right now, there are a wide range of trust options that can still allow you to take advantage of the current exemption amount. There are trust options that provide for spouses, like Spousal Lifetime Access Trusts (SLATs) and options that provide for other descendants, like Intentionally Defective Grantor Trusts (IDGTS) and Irrevocable Trusts, that can be tailored to your specific needs and your wishes for what the assets are used for.

Don’t Put Off These Decisions

If you think making changes to your estate plan to take advantage of the current exemption amount might make sense, discuss your options with your LNW team and any estate planning attorneys you may be currently working with to get plans in motion now. Bear in mind as well that quality estate planning attorneys are extremely busy amongst the exemption level uncertainty, and if you need to establish a relationship with one, that process can take some time. 2026 may seem a long way off, but it will be here before we know it.