Many people with significant wealth have a trust (or two) in their estate plan. More often than not, the trusts funded during life are “revocable” (see box below) and for a special purpose or to hold specific assets. Generally, it is after people pass away that the major pieces of their estate plan take effect. Upon death is when the will or a revocable trust serves as the pass-through mechanism to fund “irrevocable” trusts for the benefit of loved ones and charities.

A lifetime irrevocable trust, by contrast, is set up, funded, and starts to operate for the benefit of loved ones and charities while you are alive. Similar to a trust that is funded at death, lifetime irrevocable trusts can benefit multiple generations within a family.

Why establish a multigenerational trust while you are alive instead of making it part of your estate plan? There are many good reasons. For one, getting a trust up and running during your lifetime can improve the odds that it will operate as you intend and achieve what you want for your family and community. This allows you to gain conviction in your overall estate plan. Additionally, for large estates there is currently a major tax incentive to fund a multigenerational trust.

Below is a closer look at four key advantages of establishing and funding a multi-generational trust during your lifetime.

To forge a strong, long-term relationship with the trustee. Trusts intended to function over many decades are highly dependent on the capabilities of the trustee, the person or entity that administers the trust. It is vital that the trustee you choose know and understand your intent and be prepared and capable of carrying out those wishes currently and in the future.

If the trust is activated while you are alive, you can see how well the trustee is managing the assets in the trust, interacting with your beneficiaries, and carrying out your intent. If there are concerns or problems, you or someone you designate could change the trustee, assuming that is specified in the terms when the trust is written. You can also consider a trust as a tool for training and educating younger generations. Meeting with the trustee on a regular basis allows younger family members to become familiar with how the trust is managed and operates and the role the trust can play in their lives. Adult children or grandchildren can also become co-trustees for their own trusts at appropriate ages, increasing their responsibility for the trust’s success.

Both Types of Trusts Are Useful

Revocable or Living Trusts – Operate only during the lifetime of the grantor (the person setting up the trust). Assets in revocable trusts remain in the grantor’s estate and the terms can be changed at any time by the grantor. Upon death of the grantor, assets in revocable trusts avoid probate (but not estate taxes) and can be transferred to irrevocable trusts.

Irrevocable Trusts – Can operate while the grantor is alive and/or after the grantor passes away. Assets in irrevocable trusts are out of the grantor’s estate and controlled by a trustee; trust terms cannot be easily changed.

Peace of mind. Having advised families of wealth over many generations, we find there is great peace of mind that comes from observing how your legacy is manifesting when you make lifetime gifts. With a gift in trust, you have the assurance that your assets have been committed to the purpose you intend and can see the gift in action. Making sure that trust assets will go to people or organizations you love can be extremely gratifying and allow you to play a role in how the beneficiaries use those assets if you so desire.

Privacy. Using an irrevocable lifetime trust, you may have options to keep the gift secret until a future date, while still completing an important part of your estate plan. Trusts are set up as separate legal entities and operate independently. Depending on which state the trust is located in, beneficiaries may not be required to be notified about the gift and the existence of a trust for their benefit. Furthermore, a trust’s beneficial owners are kept private, which means that the wealth you have set aside for future generations will not be public information.

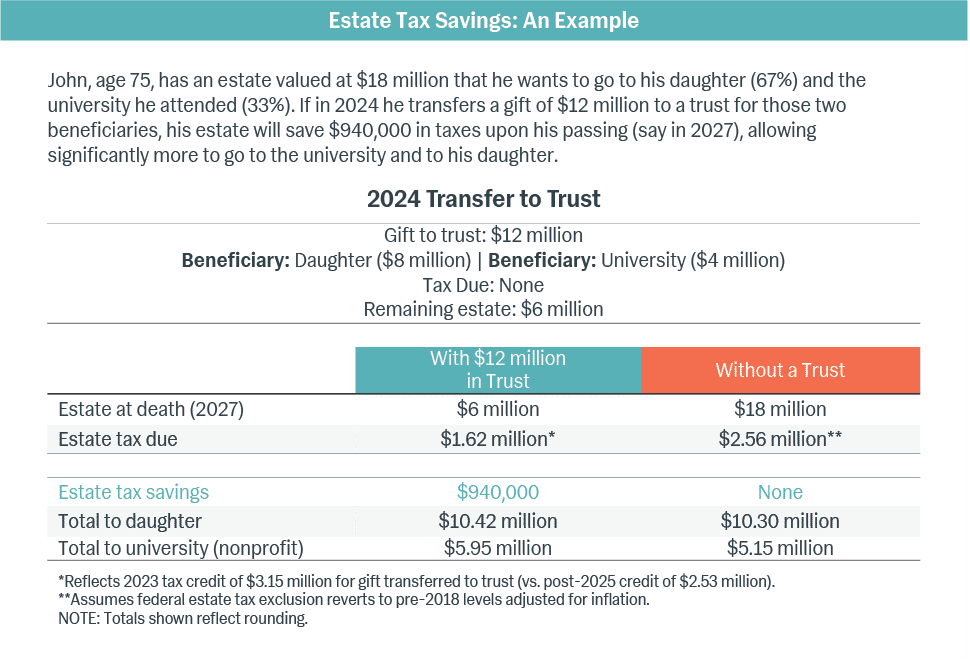

Timely tax-efficiency. Families with significant wealth have a unique (but time-limited) opportunity to fund multigenerational trusts. Currently, an individual can transfer up to $12.92 million to beneficiaries (more than $25 million for a married couple) without paying federal estate, gift, or generation skipping tax; this is double the amount allowed prior to 2018. This expanded tax exclusion is temporary; it is due to expire at the end of 2025 if not renewed by Congress.

Transferring assets to a trust now takes advantage of that opportunity. A 2019 determination from the IRS preserves the higher exclusion for those who use it before the law changes it, in essence locking it in. This has created a use it or lose it situation. The “use” means giving assets away – directly to beneficiaries or to a trust — up to the full exclusion ($12.92 million per person), which is enough to fund a trust that can benefit children, grandchildren and/or charities over a long period of time. Furthermore, a gift now freezes the value of the property for estate tax, removing its appreciation from the estate.

In Sum

All trusts – and especially multigenerational ones – must be carefully planned. They must accurately reflect current needs, future goals, the entire asset base, and the interests and capabilities of family members. As a trust company and investment advisor, we can help you implement the trust strategies that will work best for you, your beneficiaries, and the legacy you want to create.