“A long-ago client of mine had a cousin who got a big inheritance at age 21; it was gone in a few years, spent on tropical fish. His mother had no control over his spending.”

– LNW Wealth Manager

“Major money” and “young people” are a volatile mix. There’s lots that can go right but also very, very wrong. While there is no one answer as to when the younger generation should come into a big part of their inheritance, it is best to have a plan in place well before assets change hands.

For insights based on experience, we surveyed LNW Wealth Managers. It is a question they get often and for which they have seen many scenarios play out over time. Here are the major points of agreement:

1. Limit Access Before Age 25

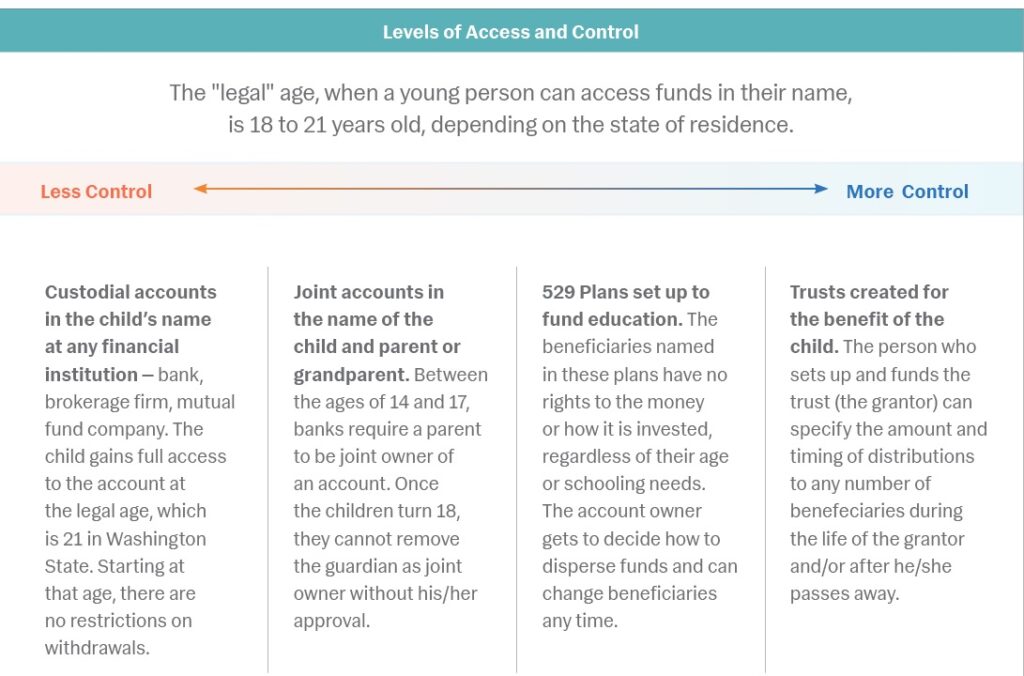

There are many ways to do this, depending on the situation.

Kristi Mathisen, Director of Tax and Financial Planning at LNW, offers this approach:

- Age 21 to 25: give young people access to income from the assets, but not the principal.

- Age 25 to 35. Allow joint control of the assets, in essence making the young person responsible but with supervision (akin to a co-trustee).

- Age 35 and up. Take off the training wheels, if the young person has shown interest and responsibility.

Adds Kristi: “If someone cannot be trusted to manage their finances by age 35, they probably will never be.“

Rodney Van Belle, LNW Wealth Manager: “Transferring major money at age 21 (or perhaps even 25) is risky, since most people at this age are exploring and likely to use a good portion of the assets to do that. Since young adults generally settle down in their 30s these days, I often recommend that assets are transferred to them starting at age 30, 35, or even 40, and usually in stages. This makes it more likely that the money will be used for things with long-term value, such as a down payment on real estate and/or help making the next career move.”

2. Give in Steps, for Specific Things

Monica Padineant, LNW Wealth Manager: “Starting out, I would give money to young adults only for specific things – to buy a car, take a trip or make a deposit on a rental. The amount of other money given should depend on what other needs they might have, with a focus on encouraging newly minted adults to work hard in school or at their first real job. Gifts should not be so large that they allow a young person to stop striving.”

3. Focus On the Recipients: Their Unique Needs, Goals, Personalities

Lee-Norah Sanzo, LNW Wealth Manager: “What is an enabling gift for one person could cause for trouble for another person. So gifting or structuring an inheritance should be done with intent and with the recipient in mind. One size does not fit all!

Carefully consider the recipients’ experience with managing money. How have they done in the past? Are they savers or spenders? Parents may want to start by giving a little money that children can manage and invest on their own as teenagers or even younger. Have them set up a budget and track their spending. Learning how to budget – how much to spend, save and donate – at a young age is a skill that pays great dividends throughout life.

If the money will eventually pass on to very young children or future generations, it is critical that the current beneficiaries not squander the assets.

Trusts provide the most control in regard to whom your assets go, when and how. And trusts can allow for your assets to last for more than one generation, if that is intended. You can specify what portion of assets or income will be distributed at various ages — say 25, 35, 40 — for various milestones (graduate school, down payment on a house, etc., birth of a child). Another major benefit of trusts is that the assets in trust are protected from creditors and also from any future divorce settlements.”

4. Consider “What If” Scenarios

Susan Zurek, LNW Wealth Manager & Trust Services: “A key thing that gets overlooked when parents leave money to children/ grandchildren are the “what ifs.” While we all hope for the best, unforeseen challenges are part of life — accidents, health issues, divorce, etc.

An irrevocable trust for the benefit of a young person can contain a statement that says something like: If something should happen, and the young person qualifies as having special needs, then the trustee is authorized to open a Special Needs Trust. Such a trust would fund the living expenses of the beneficiary but not disqualify the person from getting government aid. This can also apply to young people who have known health or behavioral issues. They may be fine now but worse off in five or 10 years. The trust would have guidelines the trustee can use to determine if the beneficiary’s condition is deteriorating and what to do in response.

My advice to clients is to think about the legacy they want to leave, think about their children and grandchildren and what would benefit them. Dollar amounts and age don’t necessarily matter because

$500,000 to one person could be like $5 million to another. We have seen children that were given money before they turned 18 and still have it and are using it wisely.

This is not an easy decision. This is why we work closely with clients to explore how to transfer assets to the next generation in a way that enables young people, furthers the family legacy and makes the most sense financially for everyone involved.”

Mind Their Money Personality

When deciding when to give money to young people, it’s a good idea to take into account their “money personality,” or their tendency toward saving, spending, risk-taking, etc. Money personalities can vary greatly within the same family. And each money personality comes with its good and bad attributes. A fun way to get a quick read on money personality is to take our MoneyPersonality Quiz

Put Family Stories to Good Use This interview with psychology professor Marshall Duke, Ph.D. explains how to use family stories to foster responsibility and resiliency in children, so they are able to make the best use of their inheritance and carry on the family legacy