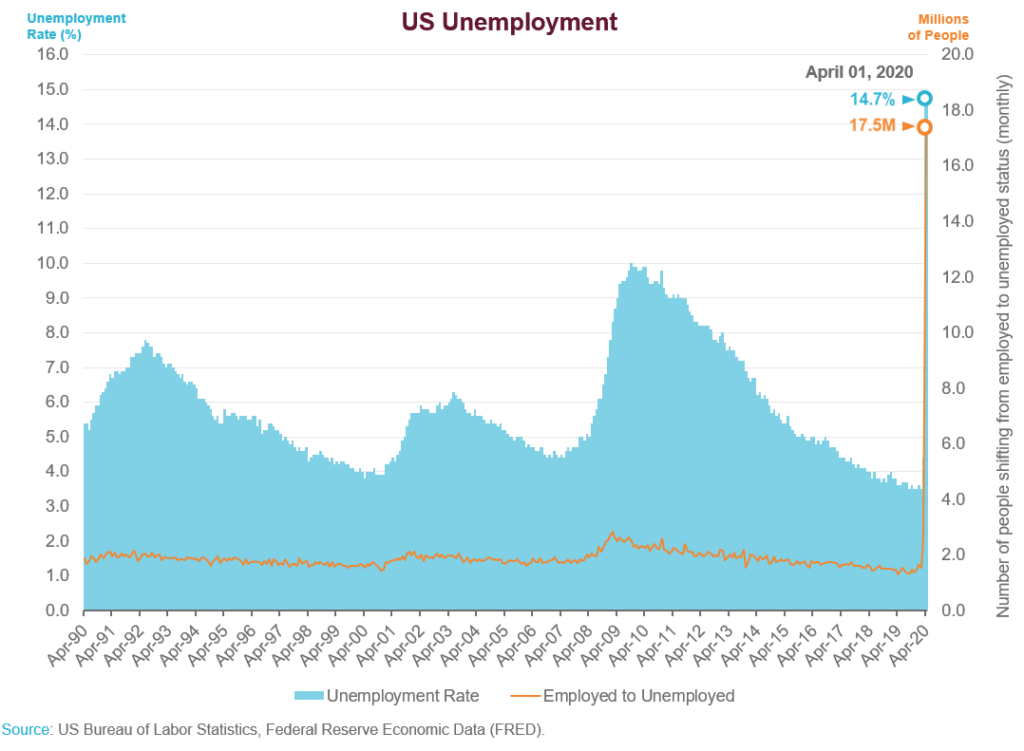

Among recent news: US unemployment is at nearly 15%, with over 20 million Americans out of work. Numerous pessimistic corporate earnings reports for 1st quarter 2020, many of which provided no forward guidance due to uncertainty regarding global growth and the timing of global economic reopening. Finally, news that some of the safest money market funds were closing to new investment. Why? Because the portfolio managers had “nowhere to put the money” (money market funds have had the greatest inflows of any asset class in 2020).

Of all this news, most concerning for us is the dramatic rise in US unemployment. So you can imagine the feeling of disbelief when we saw that US equity futures were up 1.5% and the yield on 10-year US Treasury bonds had risen 2 basis points. Based on our training and experience, this market reaction is exactly the opposite of what we would have expected. What explanation could there be for what I lightly characterize as the “disconnect” between fundamental economic data and the pricing of assets in the capital markets?

The Fed Put

For us, Mohamed El-Erian (chief economic advisor at Allianz) explains it best: “Markets are in one universe and the real economy is in the other.” He goes on to say that markets are trading a win-win situation. What he means is that there is optimism about a gradual reopening of the global economy and an eventual treatment for Covid-19; however, in case the reopening doesn’t go well, the Federal Reserve has shown itself able and willing to support markets. This is often referred to as the “Fed put,” meaning that the Federal Reserve will swoop in to buy risky assets, upholding market liquidity and confidence.

When the Covid-19 crisis began, we said that the federal government should aid citizens through all appropriate means during what is essentially a forced shutdown. I stand by that. However, the idea that the Federal Reserve can continue to purchase assets indefinitely is nonsensical and will lead to a decline in the value of the dollar and a host of other issues. We believe capital markets are efficient in the long run and assets will ultimately be priced relative to their underlying fundamentals. So let’s consider the fundamentals.

The chart above demonstrates how dire the unemployment situation is in the US. Granted, many of these unemployed people will go back to work, but how many and before how long are open-ended questions at this time. In most (if not all) economic outlooks that we’ve written so far, we’ve highlighted the importance of the consumer to the US economy: consumer spending makes up nearly 70% of US GDP. To spend freely, consumers need the income generated by steady work. The US Treasury’s Paycheck Protection Program (PPP) will help employees survive the current turmoil, but as the fallout from the pandemic continues, the limitations of PPP will become evident.

Ultimately, the health and safety of US citizens has to be evaluated in conjunction with the economic damage caused by shutdowns as we slowly emerge from the current crisis. And there will be economic damage although its extent is hard to forecast at this time. Although we are defensively allocated, our portfolio positioning has benefitted from the rebound in the stock market, given our current weighting to US equities and our overall reduction to non-US equities and bonds.

Looking Forward

Of course, interventions by the Fed and the US Treasury are not the only plausible explanations for the recent market rally, as equity markets have a history of trading higher amid bad news, aka a “bear market rally.” For example, as unemployment continued to rise in 2009, the S&P 500 gained more than 25% for the year, after bottoming in March. However, the level of unemployment we are seeing today plus the many workers furloughed is staggering. It remains to be seen how quickly they are back to work. Whether related to the economy (employment) or to health (Covid-19), the unknown factors give us pause as we look at current valuations.

Regarding our portfolios, we do believe the current disconnect between markets and the economy will ultimately prove to be a great environment for these two things: 1) Active management as opposed to index funds and ETFs; and 2) Select long-term investment opportunities. Regarding the actively managed funds we invest in, we are always vigilant in our monitoring of each manager’s investment process; however, there is an extra level of scrutiny on them today. Regarding select long-term opportunities, we continue to evaluate how to take advantage of government-sponsored programs to facilitate liquidity in the credit markets, as well as how to work with asset managers to take advantage of distressed opportunities as they arise.